European Commission proposes new anti-corruption rules

The European Commission proposed on Wednesday 3 May new anti-corruption proposals, including the establishment of a dedicated Common Foreign and Security Policy (CFSP) sanctions regime to target serious acts of corruption worldwide. “Passive or active bribery of a public official or the embezzlement or misappropriation by a public official could constitute such serious acts of corruption, especially in a country that appears on the EU list of non-cooperative jurisdictions for tax purposes, or a country that suffers from strategic deficiencies in its national regimes on anti-money laundering and countering terrorism financing that pose significant threats to the financial system of the Union”, the joint communication from the European Commission and the High Representative of the Union for Foreign Affairs and Security policy says. The proposed framework would evaluate whether corruption is a systemic issue at the root of economic, social, humanitarian, or political crisis in a third country. Other factors taken into account would be the level of gravity of the act, the amount at stake and the prominence of the public function held by the official or other persons involved, the proposal says. The Commission also put forward a proposal for a new Directive on combatting corruption within the EU, in order to modernise the existing anti-corruption legal framework.

No UNSHELL discussion at the Ecofin meeting on 16 May

The agenda of the next Ecofin meeting on 16 May has been published and it is worth noting that the policy debate initially planned on the UNSHELL Directive laying down rules to prevent the misuse of shell entities for tax purposes has disappeared. The only tax matter will therefore be the general approach on the eighth amendment of the Directive on administrative cooperation in tax matters (DAC8). On this file, two remaining issues have reportedly to be discussed further during an ambassadors’ meeting on 10 May before an agreement on a general approach can be reached. The first one is reportedly the implementation date for the exchange of taxpayer identification numbers for the purposes of DAC4. The second is the so-called switch-off mechanism that would exempt non-EU crypto service providers from reporting to the EU if they have reported the same information to their own countries and if those non-EU countries are deemed to have reporting systems equivalent to the EU ones.

European Commission asked to act as honest broker in the AMLA seat selection process

The European Parliament and the Council of the EU reportedly recently wrote to the European Commission to ask it to help them define objective criteria for determining the location of the seat of the future AML authority (AMLA). Member States usually determine the location of EU agencies on their own but the Court of Justice of the European Union recently held that the European Parliament should have a say. In its letter to the European Commission, the Swedish Presidency of the Council of the EU asked the Commission to act as an “honest broker”, evaluating offers for the AMLA seat in an objective and reasoned manner. It also urged the Commission to work as a matter of priority on the definition of objective and transparent criteria for the selection of the seat of AMLA. The Commission is also asked to work on a standardised application form that would be suitable for both co-legislators and by means of which all candidate Member States could submit their application in due time.

IASB supplementary meeting on international tax reform and SME Accounting Standard

The International Accounting Standards Board (IASB) held on Wednesday 3 May a supplementary meeting to discuss a new project to help companies that apply the IFRS for SMEs Accounting Standard to respond to the new tax rules set by the OECD. The purpose of the meeting was to accelerate progress on the project, which will result in proposed amendments to the Standard. The IASB initiated the project after gathering feedback on its project to amend IFRS Accounting Standards in response to international tax reform. The feedback suggested that large private companies and subsidiaries of multinational companies that apply the IFRS for SMEs Accounting Standard may be affected by the OECD’s Pillar Two model rules. The exposure draft on proposed amendments to the IFRS for SMEs Accounting Standard is expected to be published in Q2 2023.

Luxembourg's Engie ruling is not an illegal state aid, ECJ Advocate General says

The European Commission has wrongly found that Luxembourg granted unlawful state aid in the form of tax benefits to the Engie group, according to the opinion of Advocate General Juliane Kokott delivered on Thursday 4 May. In June 2018, the Commission concluded that the Engie group had benefited from illegal tax advantages in Luxembourg and demanded that the Grand Duchy recover €120 million from the company. According to the Advocate General, the Commission and the General Court relied from the outset on the wrong frame of reference. Indeed, they considered that the Luxembourg tax law in force at the time contained a corresponding principle, namely that an exemption of income from participations at the level of the parent company implies taxation of the corresponding profits at the level of the subsidiary. However, in Ms Kokott’s view, such a link is not obvious and its existence cannot simply be inferred by way of interpretation in Luxembourg law. The Advocate General also takes the view that it is not all incorrect advance tax rulings, but only those advance tax rulings that are manifestly incorrect in favour of the taxpayer that can constitute a selective advantage and be considered to be in breach of state aid law. Ms Kokott therefore proposes that the Court of Justice uphold the appeals and, consequently, annul the judgment of the General Court and the Commission’s decision. The Court’s judgment will be delivered at a later date and judges are not obliged to follow the Advocate General’s opinion.

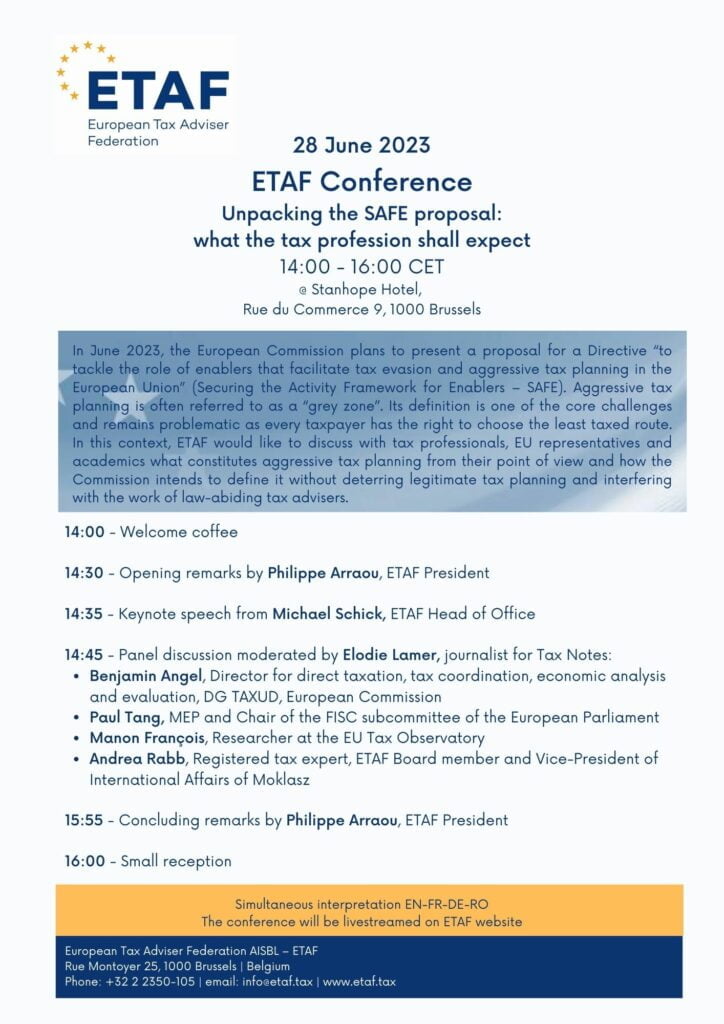

Registration for the ETAF Conference on 28 June is now open!

Register here: https://sweapevent.com/ETAFConference28June

Disclaimer

This newsletter contains information about European tax policies and developments gathered from official documents, hearings, conferences and the press. It does not reflect the official position of ETAF nor should it be taken as a written statement on behalf of ETAF.