2030 EU Strategic Agenda: further consultations

On Tuesday 2 April, the President of the European Council, Charles Michel, invited the EU leaders to a new series of informal dinners to further reflect on the EU Strategic Agenda for 2030. Following first discussions in October and November 2023, the priorities already identified by the leaders are: - a strong and secure Europe; - a prosperous and competitive Europe; - a free and democratic Europe. The informal dinners will be held in Vilnius, Bucharest, Warsaw and Vienna. The aim for the participants will be to specify the EU’s future objectives in each area, to define concrete measures and financial resources to meet these goals. A more detailed draft Strategic Agenda will be prepared and submitted to the European Council at the end of June alongside the roadmap for future work on internal reforms in the context of enlargement.

EU Finance Ministers meet in Luxembourg on Friday 12 April

EU Finance Ministers are due to meet on Friday 12 April in Luxembourg. According to the agenda of the meeting, they will exchange views and seek to adopt conclusions on the implementation of the Recovery and Resilience Facility (RRF). Ministers will also discuss the state of play of the economic and financial impact of Russia’s aggression against Ukraine. Furthermore, the Ecofin Council will seek to approve the EU’s mandate for the G20 Finance Ministers’ and central bank governors’ meeting of 18 April 2024 and will aim to approve an EU statement for the International Monetary and Financial Committee. Finally, they will attend a presentation by the European Public Prosecutor's Office (EPPO) about its activities, notably to combat VAT fraud.

European Commission rejects the prospect of a war tax on EU companies in Russia

In a written answer to a parliamentary question published on Tuesday 2 April, EU Tax Commissioner, Paolo Gentiloni, rejected a call for introducing a war tax on EU companies still operating in Russia, stating that Member States have the competence to design their own tax systems and decide whom to tax. However, Mr Gentiloni recalled that EU companies must at all times respect applicable Union restrictive measures, including any sectoral restrictive measures, such as trade restrictions and asset related ones, adopted by the Council, and that they could be held liable in case of violations. Due to successive packages of sanctions adopted throughout 2022 and 2023, over 60% of EU imports from Russia prior to the invasion have been placed under restrictive measures, covering important sectors such as energy, steel, wood, machinery, vehicles, and metal products, Mr Gentiloni recalled. 58% of EU exports to Russia have also been placed under the EU restrictive measures as of December 2023, he added. In February 2024, MEP Marek Belka (S&D, Poland) asked the European Commission if it considers addressing the “irresponsible and mainly profit-oriented behaviour” by European multinationals doing business and paying taxes in Russia, thus aiding the Russian government in its war against Ukraine, and imposing additional taxes on them.

France wants to launch an EU-wide administrative simplification project

At a tripartite meeting in Paris on Monday 8 April, the French Finance Minister, Bruno Le Maire, will reportedly propose to his German and Italian counterparts, Robert Habeck and Adolfo Urso, that after the European elections they launch together an EU-wide administrative simplification project to start cutting red tape. France will propose to Germany and Italy that, after June, a so-called “omnibus” directive be drawn up to revise all European standards, he reportedly told journalists on Thursday 4 April. The French Ministry of the Economy would also suggest that the threshold for the number of employees qualifying as an SME be raised from 250 to 500, allowing mid-cap companies to be excluded from certain regulatory obligations in the area of accounting and financial standards and non-financial reporting.

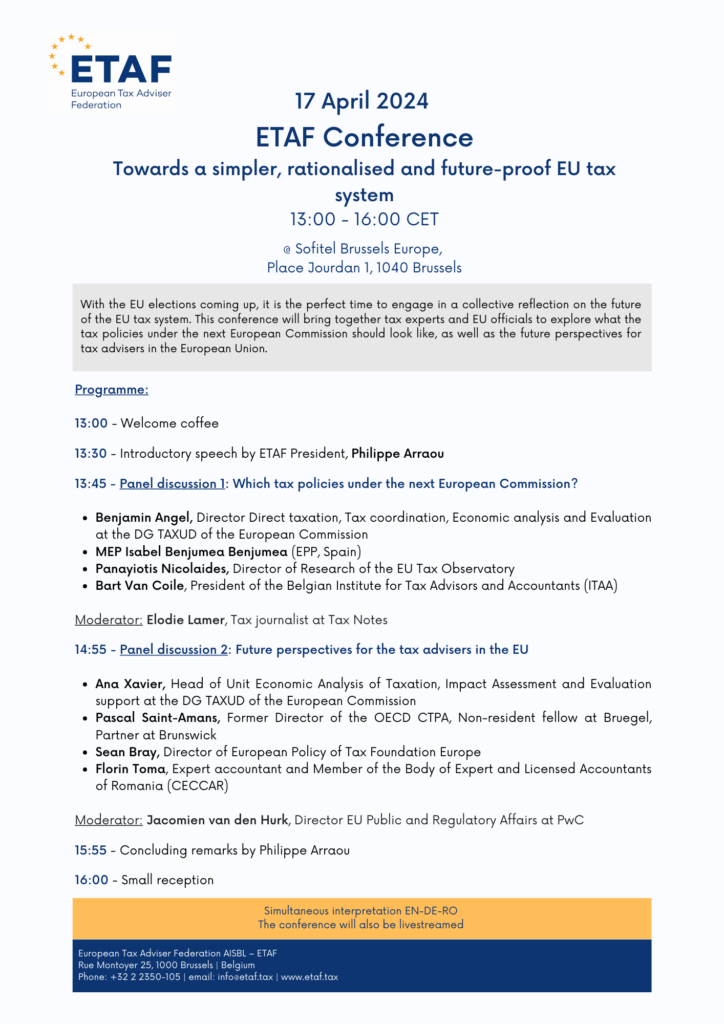

ETAF Conference on 17 April 2024

Register here: https://sweapevent.com/etafconference17april2024