EU Tax Observatory annual conference in Brussels

On Tuesday 30 May, EU officials, researchers and tax experts gathered at the annual conference of the EU Tax Observatory in Brussels. Entitled “Investing in the Future of Europe: Building the EU’s Own Resources”, the conference was divided into three sessions. During the morning session dedicated to corporate taxation, Benjamin Angel, Director for direct taxation, tax coordination, economic analysis and evaluation at the European Commission, spoke about the upcoming new framework for corporate taxation in Europe (BEFIT) and said that it will bring a series of simplifications, notably for SMEs. One measure will be to allow an SME to operate - when it has activities in another Member State without subsidiaries - exclusively under one single tax base. Asked about the postponement of the SAFE proposal on aggressive tax planning, Mr Angel said one should not overinterpret the Commission’s tentative agenda. The delays are just to be attributed to the fact that there are many priorities in many other fields and that some topics have to be prioritized but he assured that the Commission is still working on SAFE. When asked if SAFE will come still this year, he only praised the audience to “be patient”. The second session in the afternoon on how to fight tax avoidance more effectively also touched upon the SAFE initiative. Speaking in the panel, ETAF head of office, Michael Schick, recalled that regulated tax advisers are not enablers of aggressive tax planning and that tax avoidance is not illegal as far as it is done within the boundaries of the laws. All speakers agreed that the definition of aggressive tax planning will be key. A clear and practicable definition will be essential for the daily work of tax advisers, Mr Schick pointed out.

DG TAXUD 2023 management plan

The European Commission published on Tuesday 30 May the management plans for its DGs. Each year, European Commission departments define their main actions and how these will contribute to meeting the overall objectives of the Commission. It is worth noting that the 2023 management plan of the DG Taxation and Customs (DG TAXUD) refers to the SAFE proposal on aggressive tax planning and says that it will “target those that encourage the use of complex structures in third countries to evade or avoid tax, and will put forward a harmonised EU approach to penalties for such actions”. It mentions other expected initiatives such as the new framework for corporate taxation in Europe (BEFIT) and the new proposal to improve Withholding Tax Relief Procedures in the EU. The management plan also says that the Commission will submit to the Council of the EU, by 30 June 2023, a report on the progress made on Pillar One of the OECD agreement, with a view to providing more clarity on the plans for the EU proposal. In 2023, DG TAXUD also plans to carry out a study and propose new measures to reduce the time, cost and effort currently required to solve VAT disputes and to publish a communication on taxpayers’ rights. Finally, the Commission will organise another high-level Tax Symposium event in Autumn 2023, to take stock of the progress made on the reflexion around the future of taxation.

MEPs urge Member States to put the UNSHELL Directive back on the agenda

In a column published in Euractiv on Tuesday 30 May, MEPs Paul Tang (S&D, The Netherlands), Gilles Boyer (Renew Europe, France) and Ernest Urtasun (Green/EFA, Spain) urged Member States to put the proposal for an UNSHELL Directive, laying down rules against the misuse of shell entities for tax evasion purposes, on the agenda again. “After diluting the proposal beyond recognition, the Swedish Council presidency failed to put even this watered-down version forward to the EU finance ministers at their meeting in May”, MEPs regretted. They urge the Swedish and the upcoming Spanish EU Council presidency to put the UNSHELL Directive on the agenda of the coming meetings of finance ministers and have the Council meeting live-streamed. “European citizens have at least the right to hear the explanation of their governments – one by one – as to why they block this directive and do not move forward in the fight against tax avoidance. Of course, we will do everything within our reach to make this the most watched Council meeting ever”, they say.

New European Commission’s tax infringement proceedings

The European Commission launched on Thursday 1 June a series of new infringement proceedings. On tax matters, Greece and Cyprus are on the Commission’s radar. Greece indeed received an additional letter of formal notice for not applying properly EU rules on second-hand vehicles purchased in other EU Member States. According to the Commission, Greece’s environmental tax discriminates between second-hand vehicles bought and registered in Greece and second-hand vehicles purchased in other Member States, and subsequently registered in Greece. The Commission also sent a reasoned opinion to Cyprus for its failure to properly apply EU VAT rules for dwellings purchased or constructed in Cyprus. The Commission considers that the Cypriot legislation allowing a reduced rate of VAT of 5% on the first 200m2 of dwellings used as the principal and permanent residence by the beneficiary, without any other limitations, goes beyond what is allowed by the VAT Directive. The two countries have two months to reply to the Commission or the institution may decide to go to the next step of the infringement proceeding.

IASB consults on amendments to IFRS for SMEs Accounting Standard related to international tax reform

The International Accounting Standards Board (IASB) proposed on Thursday 1 June amendments to the IFRS for SMEs Accounting Standard to help SMEs respond to the international tax reform. The proposed amendments to the income tax section of the standard would provide the same relief as the amendments to IAS 12 Income Taxes issued in May 2023, and also come in response to the OECD Pillar Two model rules. The proposed amendments would: - introduce a temporary exception to accounting for deferred taxes arising from the implementation of the Pillar Two model rules; - introduce targeted disclosure requirements in periods when Pillar Two legislation is in effect; and - clarify that “other events” in the disclosure objective for income tax include enacted or substantively enacted Pillar Two legislation. The exposure draft is open for comment until 17 July 2023. An online survey has also been provided to make it easier for stakeholders to submit comments.

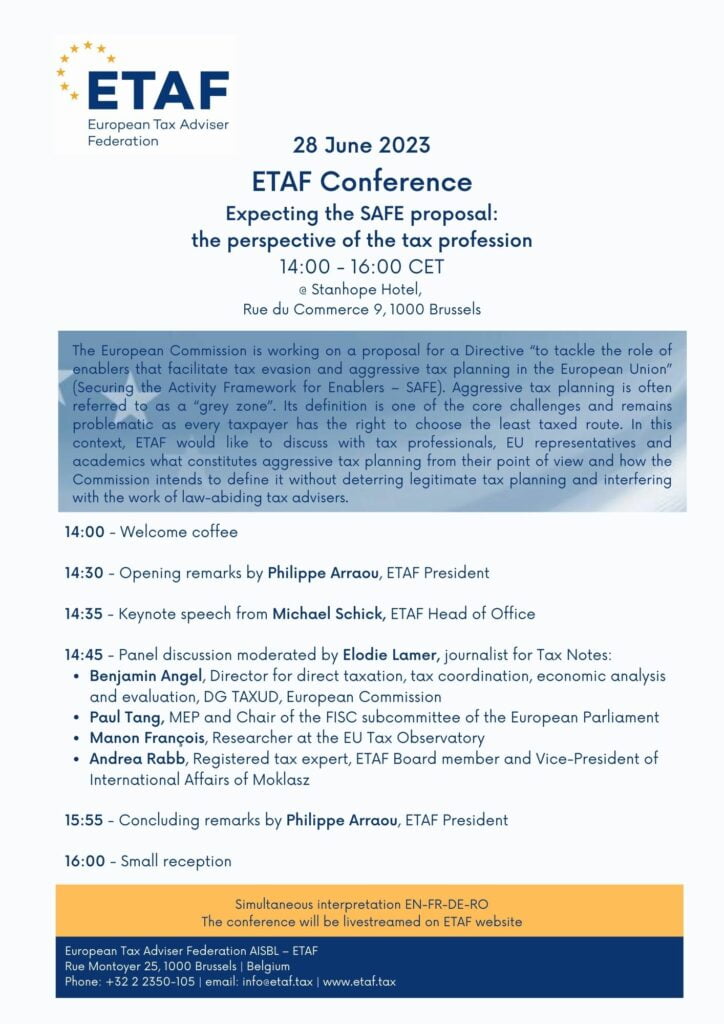

Reminder - ETAF Conference on SAFE on 28 June

Register here: https://sweapevent.com/ETAFConference28June

Disclaimer

This newsletter contains information about European tax policies and developments gathered from official documents, hearings, conferences and the press. It does not reflect the official position of ETAF nor should it be taken as a written statement on behalf of ETAF.