European Commission unveils its new Single Market Strategy

The European Commission presented on Wednesday 21 May its new Single Market Strategy, which identifies the 10 most burdensome barriers to the development of the Single Market (the so-called “Terrible Ten”). Particularly relevant for the profession is the intention to significantly simplify the recognition of professional qualifications through harmonised assessment standards and the use of digital tools. Tax advisory services are explicitly identified as a highly regulated profession with significant economic impact. The Commission plans to support Member States through guidance and recommendations to avoid unnecessary regulation that could hinder investment and trade. It is also proposed to facilitate cross-border service provision further through the harmonisation of authorisation and certification schemes. The European Commission would like service providers already authorised or certified under EU law in one Member State to be able to offer their services in other Member States without the need for additional authorisation or certification. If needed, a “Single Market Barriers Prevention Act” could be introduced by Q3 2027 to prevent the emergence of new obstacles. The strategy also includes a proposed “28th Regime” to facilitate the digital setup of EU-wide business, potentially incorporating tax elements. Additionally, the Commission plans to update its 1994 Recommendation on business transfers, having several tax implications, and to revise the acquis on E-Invoicing in public procurement turning the existing Directive into a Regulation and making the EU E-Invoicing standard mandatory for public procurement. The Strategy was presented to both the Competitiveness Council and the European Parliament on Thursday 22 May and to the European Parliament, for a first exchange of views.

Fourth Omnibus simplification package

Alongside its new Single Market Strategy, the European Commission published on Wednesday 21 May a new Omnibus package of simplification measures, which introduces a definition for small mid-cap companies, i.e. companies with fewer than 750 employees and either up to 150 million € in turnover or up to 129 million € in total assets. This fourth Omnibus package will lift burden for EU businesses by extending exceptions applicable to SMEs to small mid-caps, by removing obligations to provide product compliance documentation in paper format, by giving businesses the choice to provide instructions of use digitally and by providing a solution for products that cannot get to the market because of lack of standards. The strategy sets out targeted amendments to eight key EU legislative acts. These cover areas such as data protection, trade defense, financial markets, environmental sustainability and the resilience of critical infrastructure. The European Commission announced that further Omnibus proposals will follow, including a Digital Omnibus aimed at simplifying the Single Market legislation also in the digital sphere and an Environmental Omnibus to facilitate compliance in particular with Extended Producer Responsibility (EPR) obligations. More information can be found here.

European Commission updates on tax simplification efforts at EESC public hearing

On Wednesday 21 May, the European Economic and Social Committee (EESC) held a public hearing titled "Simplifying the tax framework: Proposals from civil society". During the event, Bernardus Zuijdendorp, Head of Unit for Company Taxation at the European Commission’s DG TAXUD, outlined the Commission’s approach and progress in its tax simplification initiative. Mr Zuijdendorp detailed two key workstreams of the project. The first involves a comprehensive mapping of the EU’s existing legislation in direct taxation. This includes a review of various directives such as the Interest and Royalties Directive, Parent-Subsidiary Directive, Merger Directive, Directive on Administrative Cooperation (DAC) from DAC1 to DAC7, Anti-Tax Avoidance Directive (ATAD) I and II, the Dispute Resolution Mechanism Directive and the Pillar Two Directive. He also noted that the simplification efforts would extend to indirect taxation. The second workstream focuses on evaluations and studies to support the simplification agenda. These include an evaluation of the DAC, which began in 2023 and is set for publication in 2025, and an evaluation of the ATAD, launched in 2024 and due by the end of 2025. The next steps involve meetings with Member States in Summer to discuss potential proposals and establish priorities for a 2026 initiative. Henrik Paulander, Head of Sector for Exchange of Information at DG TAXUD, presented an update on the DAC simplification efforts. He emphasised the goals of reducing administrative burdens for both reporting entities and tax authorities by minimising overlapping requirements, streamlining processes and introducing common tools and guidance. The reform also aims to enhance the clarity, coherence, and usefulness of information shared under the DAC framework, he said. All presentations from the speakers are expected to be made available online shortly.

Polish Presidency proposes integrating UNSHELL into DAC6

The Polish Presidency of the Council of the EU is reportedly considering a proposal to incorporate elements of the draft UNSHELL Directive — aimed at addressing the misuse of shell entities — into the existing DAC6 framework, rather than adopting UNSHELL as a standalone directive. This proposal is expected to be discussed at the upcoming Working Party on Tax Questions meeting on Tuesday 27 May. The latest UNSHELL approach, discussed in November 2024, is quite different from the original proposal. It no longer set out an economic substance test for determining whether an entity is a shell or not, but rather hallmarks that would trigger entities meeting them to report to their tax authority every year in their tax return which hallmarks they meet. In a note, the Presidency would now reportedly suggest that entities deemed high-risk under the UNSHELL criteria may already fall within the scope of DAC6 reporting requirements for cross-border aggressive tax arrangements. As such, maintaining separate obligations under both frameworks could result in duplicate reporting, increased administrative and compliance burdens and a negative impact on the competitiveness of the EU internal market, it says. In line with the EU’s broader tax simplification agenda, the Polish Presidency would therefore argue that the goals of UNSHELL could be effectively achieved by refining or clarifying the existing DAC6 hallmarks.

European Commission remains cautious on an EU-wide minimum tax on High-Net-Worth Individuals

In response to a written question from MEP Fabio De Masi’s inquiry, the European Commission acknowledged on Monday 19 May the EU Tax Observatory’s proposal for an EU-wide minimum tax on ultra-high-net-worth individuals and linked it to broader global efforts championed by the Brazilian Presidency of the G20. While the Commission did not explicitly endorse the Observatory’s proposal, it highlighted the need for fairer, progressive taxation systems and respect the principle of tax sovereignty among Member States. It stresses the current diversity in wealth and capital income taxation across the EU, and outlines prerequisites such as improved information exchange on beneficial owners and on real estate for any unified action. To deepen its understanding, the Commission initiated a comprehensive study on wealth-related taxes in December 2024, with findings expected by the end of 2025. This study aims to assess the feasibility and effectiveness of such taxes in both EU and non-EU contexts, the Commission says. Additionally, the Commission continues monitoring the impact of tax systems using the EUROMOD tool to evaluate how tax and benefit schemes affect income distribution and work incentives. While supportive of further exploration, the Commission remained cautious, emphasising the need for robust data first.

Next FISC Subcommittee activities

The European Parliament’s FISC Subcommittee will undertake a mission to Abu Dhabi and Dubai from 26 to 28 May 2025, led by Chair MEP Pasquale Tridico (The Left, Italy). The delegation will meet with senior UAE officials, including the Minister of State for Financial Affairs and members of the Federal National Council, to discuss key issues in international taxation, tax transparency and the fight against tax evasion and avoidance. The agenda will also address the UAE’s implementation of OECD/G20 tax reforms, its attractiveness to multinational enterprises and high-net-worth individuals, and its progress on good tax governance and anti-money laundering standards. The week after, the FISC Subcommittee will convene on Tuesday 3 June in Brussels for its next meeting, which will feature a workshop on the taxation of the EU’s financial sector and a non-public exchange with the US Treasury on international tax policy under the new US administration. The agenda of the meeting is available here.

EU and UK agree to work towards linking their Emission Trading Systems

The EU and the UK announced that they will work towards linking their emissions trading systems (ETSs) during a joint summit in London on Monday 19 May, among announcements of cooperation in other areas such as security and defence, health, energy, justice and irregular migration. The statement, issued at the end of the Summit, promises mutual exemptions from each side’s Carbon Border Adjustment Mechanisms (CBAMs) and should cover sectors including electricity generation, industrial heat generation, industry, maritime transport and aviation, with a procedure to be put in place to expand to additional sectors. The joint statement emphasised that the linkage will not hinder either party’s ability to pursue more ambitious climate goals, aligning with international commitments.

Global Tax Platform releases principles to reform tax incentives

On Tuesday 20 May, the Platform for Collaboration on Tax — a joint initiative from the IMF, OECD, UN and World Bank — released updated principles to guide policymakers in designing effective tax incentives that avoid economic distortion and revenue loss. The report outlines six aspirational principles urging governments to justify incentives by proving they deliver broader societal benefits beyond private gains. It emphasises transparency, recommending clear cost assessments, sunset provisions and safeguards against abuse, such as limits on profit-based incentives that risk facilitating tax avoidance. Incentives should align with global tax rules, including the global minimum tax, and be simple, targeted, and subject to ongoing oversight by Finance Ministries and legislatures, the report says. The report calls for all incentives to be codified in law, backed by anti-abuse measures and administered without waiving compliance standards. Effective interagency cooperation, public expenditure reporting, and regular policy evaluations are also key recommendations.

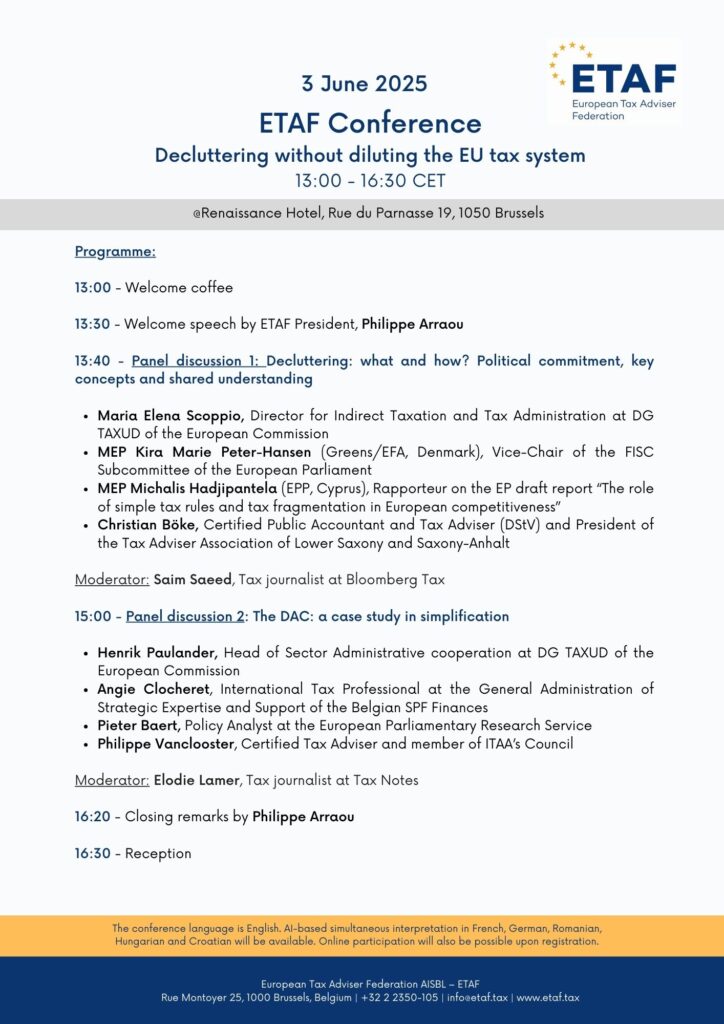

ETAF Conference on 3 June 2025 in Brussels: join us!

Register here:https://sweapevent.com/b?p=etafconferencedeclutteringwithoutdilutingtheeutaxsystem