European Commission unveils its FASTER proposal

The European Commission released on Monday 19 June a new framework for “Faster and Safer Relief of Excess Withholding Taxes” (FASTER). The proposal was initially expected on 28 June but, as other tax proposals, has been removed from the Commission’s indicative agenda. The problems the Commission aims to tackle with this initiative are the particularly burdensome withholding tax refund procedures for cross-border investors in the EU and, at the same time, the risks they present in terms of tax abuse, as demonstrated by the ‘Cum-Ex’ scandal. The Commission is, among other things, proposing that Member States could choose between a relief-at-source system and a quick refund system in a set time frame. Member States would be able to decide which system to use, as long as one is put in place, and be free to choose whether to outsource the tasks to a withholding task agent. To benefit from these two fast-track procedures, investors will need to contract with “certified financial intermediaries” that are included in a national register that Member States will have to set up. Member States will also be able to rely on a common EU digital tax residence certificate to confirm the EU taxpayers’ tax residency. The proposal should come into force on 1 January 2027. The deadline to give a feedback to the Commission on this proposal is currently 21 August 2023 but will be extended every day until the proposal is available in all EU languages.

European Commission presents an adjusted package of new own resources for the EU budget

The European Commission published on Tuesday 20 June an “adjusted” package of new EU own resources, to complete and update the package it put forward back in December 2021. The Commission is proposing some adjustments to the own resources proposals based on the ETS and CBAM, to reflect the changes brought by co-legislators in their recent agreements on these proposals, as well as a new temporary statistical own resource based on company profits. Last year, the Commission initially announced an own resource based on BEFIT. Now, it presents this statistical own resource as a temporary measure until a BEFIT agreement is reached. This temporary own resource comes with a 0.5% call rate to the gross operating surplus statistics recorded for the sector of financial and non-financial corporations of each Member States under the European system of accounts (ESA). This contribution is not a tax on companies and will not increase their compliance costs, the Commission assured. The Commission proposes that the contribution from the statistical based own resource on company profit applies as of 2024. According to its estimates, it would provide revenues of about €16 billion (2018 prices) per year. The Commission also adds that the own resource based on Pillar One is maintained but as the necessary multilateral convention has not yet been signed and ratified, it cannot yet enter into force. The proposed adjustments will enter into force once agreed by Member States in the Council, after seeking the opinion of the European Parliament, and ratified by Member States in accordance with their respective constitutional requirements.

FISC subcommittee concludes its mission in London

A delegation of MEPs from the subcommittee on tax matters (FISC) of the European Parliament completed their mission on Tuesday 20 June to London where they discussed tax matters with British stakeholders and counterparts. Speaking at the end of the mission, delegation leader and Chair of the subcommittee MEP Paul Tang (S&D, The Netherlands) noted that both the EU and the UK share the same objective of improving the fight against tax fraud and aggressive tax planning. He also welcomed that the UK is considering introducing a bill that would make enablers accountable in the case that they would not have prevented a tax crime to occur. The other two MEPs of the delegation were German MEPs Rasmus Andresen (Greens/EFA) and Gunnar Beck (ID). During the two-day mission, the delegation met with members of the Public Accounts Committee, the Treasury Committee and the All-Party Parliamentary Group on Anti-Corruption and Responsible Tax of the House of Commons, as well as HM Treasury Minister Baroness Joanna Penn and stakeholders from civil society, professional associations and academia. The discussions focused on the implementation of the OECD/G20 international tax reform, UK efforts to combat tax evasion and avoidance, and the role of intermediaries and International Financial Centres in the fight against tax evasion and tax avoidance. Discussions also revolved around tax policies in the UK post-Brexit and the impact on the EU, administrative cooperation, transparency rules, windfall profit taxes, the future of financial service taxes and the implementation of the Windsor Framework in the area of VAT and excise duties, a press release says.

France calls for the adoption of a New Global Financing Pact

France gathered on Thursday 22 June and Friday 23 June more than 300 high-level participants, Heads of State and Government, international organizations and representatives of civil society and the private sector in Paris. The aim of the Summit was to lay the groundwork for a renewed financial system suited to the common challenges of the 21st century, such as fighting inequalities and climate change and protecting biodiversity. During the panel on ‘Partnerships for Green Growth’, the President of the European Commission, Ursula von der Leyen, reportedly called for concerted action and highlighted the importance of carbon pricing and the introduction of a scheme such as the EU Emissions Trading Scheme, which could generate considerable funding. Other speakers, such as Laurence Tubiana, President and Executive Director of the European Climate Foundation, called for greater creativity in looking at all possible financial options, from a financial transaction tax to contributions from oil and gas companies and taxing the freight transport industry. She also said that we need to make sure that money goes back to the most vulnerable people. In his final speech, French President Emmanuel Macron reportedly called for a global mobilisation to introduce international taxes on financial transactions, airline tickets and shipping.

EU adopts 11th package of sanctions against Russia

The Council of the EU adopted on Friday 23 June an 11th package of sanctions against Russia. Among other things, it includes a “new anti-circumvention” tool which will allow the EU to restrict the sale, supply, transfer or export of specified sanctioned goods and technology to certain third countries whose jurisdictions are considered to be at continued and particularly high risk of circumvention. The package also prohibits the transit via the territory of Russia of more goods and technology which may contribute to Russia’s military and technological enhancement or to the development of the defence or security sector, goods and technology suited for use in aviation or space industry and jet fuel and fuel additives, exported from the EU to third countries. Moreover, the Council added additional 87 entities to the list of entities directly supporting Russia’s military and industrial complex in its war of aggression against Ukraine, which will be subject to tighter export restrictions concerning dual use goods and technologies. In addition to economic sanctions, the Council decided to list over 100 additional individuals and entities and to subject them to asset freezes.

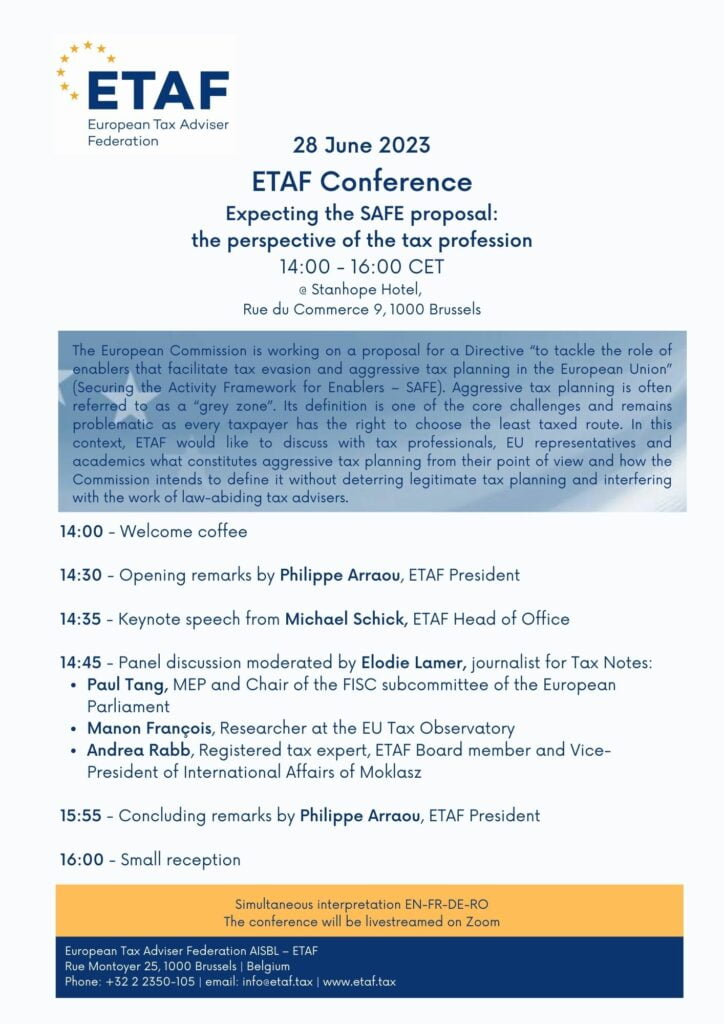

Reminder ETAF conference on 28 June on SAFE

Register here: https://sweapevent.com/ETAFConference28June

Disclaimer

This newsletter contains information about European tax policies and developments gathered from official documents, hearings, conferences and the press. It does not reflect the official position of ETAF nor should it be taken as a written statement on behalf of ETAF.