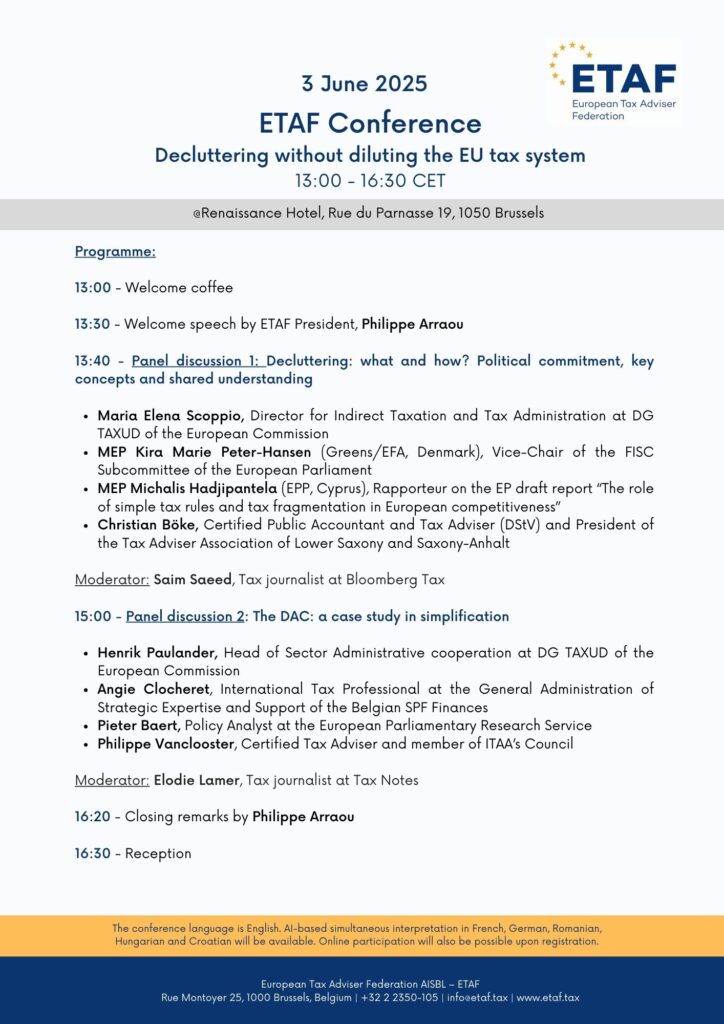

Last day to register to the ETAF Conference on 3 June 2025 in Brussels!

Register here: https://sweapevent.com/b?p=etafconferencedeclutteringwithoutdilutingtheeutaxsystem

European Commission presents a Scale-up and Start-up strategy

The European Commission published on Wednesday 28 May its EU Startup and Scaleup Strategy to “make Europe the best place in the world to launch and grow global technology-driven companies”. The strategy sets out a number of legislative, policy and financial support measures in support of European startups and scaleups, at both EU and Member States level. It is structured around the following pillars: innovation-friendly regulation, better finance, fast market uptake and expansion, support for the best talent, and access to infrastructure, networks and services. The Commission will notably propose in Q1 2026 a definition of startups, scaleups and innovative companies, taking into account existing definitions of SMEs and small mid-caps. It will also propose in Q1 2026 a European 28th regime, including an EU-wide optional corporate legal framework, based on digital-by-default solutions. This new legal framework is supposed to “simplify applicable rules and reduce the cost of failure, by addressing specific aspects within relevant areas of law, including insolvency, labour and tax law”. In particular, the Commission would like to explore the possibility of enabling companies to establish in Europe more rapidly, ideally within 48 hours. In addition, in 2025-2026, the Commission will explore best practices concerning the treatment of Employee Stock Options (ESO) for startups, including considering legislative measures to harmonise certain aspects of their treatment to reduce administrative complexity and encourage more startups to offer ESOs as a competitive benefit.Finally, a recommendation to Member States to eliminate tax obstacles for remote cross-border employees for startups and scaleups will also be issued.

15 Member States urge European Commission to move forward with its tobacco taxation proposal

A coalition of 15 EU Member States, including Germany, France, Spain and the Czech Republic, is reportedly pressing the European Commission to move forward “without delay” on a long-awaited reform to the tobacco taxation Directive, last revised in 2011. In a recent letter to Commission President Ursula von der Leyen, these countries reportedly call for the immediate unblocking of the proposal that would, for the first time, introduce minimum excise rates on vapes, heated tobacco and nicotine pouches, while also significantly increasing minimum taxes on traditional cigarettes and cigars. “The current scope and provisions of the directive are insufficient to enable member states to deal with the significant challenges posed by ongoing developments and trends in the European tobacco market, including the emergence of novel products”, the 15 EU Finance ministers wrote in the letter. The signatories argue that the update is vital for public health, to harmonise taxation across the EU and to combat illegal trade. The proposal, originally scheduled for 2022, was delayed due to soaring inflation but a new proposal would be expected in a near future.

Member States open to the idea of integrating UNSHELL into DAC6

At a Working Party on Tax Questions on Tuesday 27 May, EU Member States reportedly supported the proposal from the Polish Presidency of the Council of the EU to incorporate elements of the draft UNSHELL Directive — aimed at addressing the misuse of shell entities — into the existing DAC6 framework, rather than adopting UNSHELL as a standalone directive. While the idea was generally welcomed, several countries reportedly raised concerns about adopting a one-size-fits-all solution and emphasised the importance of avoiding double reporting. Some Member States also proposed delaying changes until the European Commission completes its evaluation of DAC6 and drafts the DAC10 proposal, expected in early 2026.

ECON committee publishes new draft opinion on BEFIT

The European Parliament has restarted work on its non-binding opinion on the Business in Europe: Framework for Income Taxation (BEFIT) proposal due to the European elections rendering the 2023 draft report obsolete. MEP Evelyn Regner (S&D, Austria), rapporteur for the ECON opinion, published a new draft report on 12 May, supporting the proposal's goal of harmonising the corporate tax base across the EU. Ms Regner highlights that fragmented tax systems hinder cross-border investment, raise compliance costs and distort competition. Her report proposes several changes compared to the initial proposal of the Commission including: lowering the revenue threshold to include all large groups under the Accounting Directive, adapting interest limitation rules, strengthening CFC rules, refining depreciation rules to prevent tax base loss, and restricting tax incentives while prioritising R&D. A major change includes replacing the transitional apportionment rule with a post-2035 allocation formula based equally on labour, assets, and sales, aiming to curb tax avoidance and simplify compliance. The ECON committee will vote on the report on 24 September, with a Plenary vote scheduled for 12 November.

Call for application for the European Commission’s VAT expert group

The European Commission opened on Wednesday 28 May a call for application for experts in the field of VAT, at both national and EU level, to form part of the Commission’s VAT Expert Group (VEG). The VEG is a formal expert group composed of business representatives, tax practitioners and academics. Set up in 2012, the VEG’s mission is to provide advice and expertise to the Commission on the preparation of legislative acts, policy initiatives and any other matter relating to the preparation and implementation of EU legislation and other policy initiatives in the field of VAT. The current members of the VEG were appointed in September 2022 for a mandate of 3 years, which will expire in September 2025. Applications must be sent by 24 June 2025.

DG TAXUD Annual Report on Taxation 2025 event on 24 June

On 24 June, the European Commission will host a half-day event (09:30 – 13:00) to mark the publication of a new edition of the Annual Report on Taxation (ART) both onsite in Brussels and online. The event will bring together leading experts to discuss key trends in EU tax systems and the data behind tax policy. This year’s theme, “Fair and effective taxation: Strengthening compliance and progressivity”, will guide discussions on how tax policy can promote fairness, strengthen compliance, and support sustainable public finances – drawing directly from the report’s findings. More information is available here.