Member States reach agreement on new rules to incentivise the use of the IOSS

EU Finance Ministers reached on Tuesday 13 May an agreement on the Directive concerning VAT rules for distance sales of imported goods and import VAT. Initially, the European Commission proposed making the Import One-Stop Shop (IOSS) mandatory to simplify VAT compliance for imports. However, due to limited support among Member States, the idea of a mandatory IOSS use was replaced with an approach designed to incentivise its use. Under the agreed rules, foreign suppliers and platforms will be made liable for import VAT and VAT on the distance sales of imported goods in the Member State of the final destination of the goods. This will encourage the use of the IOSS, as foreign traders or platforms that do not use it will need to register in every Member State where they sell goods. The IOSS also ensures VAT is collected at the time of purchase, rather than at the border, thus shifting the administrative burden from consumers to platforms. Moreover, non-EU suppliers who do not use the IOSS will be required to appoint a tax representative in the EU, unless they are based in a country with a mutual assistance agreement under Commission Implementing Decision (EU) 2021/942. In an annexed statement, the Council acknowledges the need to resolve outstanding technical and operational issues related to the implementation of the incentivised IOSS, particularly around VAT–customs interactions. The European Commission is notably invited to provide appropriate clarifications and guidance. This Directive will now have to be formally adopted and the European Parliament will have to be consulted, before it can enter into force.

European Commission releases study on health taxes from an EU perspective

A new study commissioned by the European Commission and released on Thursday 15 May makes a strong case for taxing high-fat, high-salt and high-sugar (HFSS) products, particularly advocating for EU-wide harmonisation of sugar-sweetened beverages (SSB) taxes. Based on national data from 2009–2021, the study finds that these taxes can effectively reduce consumption, encourage product reformulation and generate public health benefits when tax rates are sufficiently high and well-designed. While eleven EU countries have implemented HFSS taxes — mostly targeting SSBs — effects vary by country, tax structure and socioeconomic context, the authors found. The study recommends introducing a minimum excise tax, with a progressive structure encouraging product reformulation. “Such a minimum tax would translate into positive health effects, such as a reduction in BMI (Body Mass Index)I and in the incidence of related diseases such as ischemic heart diseases and diabetes”, the authors state.The easiest option, according to the authors, would be taxing SSBs, targeting drinks with added or free sugars.Three scenarios are examined, with tax rates ranging from 2€ to 15€ per hectoliter, depending on sugar content. The highest tax scenario could generate up to 900 million € in revenue, according to the study.

FISC Subcommittee discusses Pillar Two implementation after US withdrawal

On Thursday 15 May, MEPs from the FISC Subcommittee of the European Parliament heard experts about the prospects for global tax rules in the light of the Trump administration backing down from some of the tax commitments made previously by the US. Speakers included Manal Corwin, Director of the OECD Centre for Tax Policy and Administration, Petr Janský, Professor of Economics and Director of the CORPTAX Research Group of the Charles University in Prague and Nadine Riedel, Professor and Director of the Institute for Public and Regional Economics of the University of Münster. During the exchange session, MEPs wanted to know more about options to successfully continue applying the global minimum tax rate agreement while at the same time appeasing some of the concerns raised by the US. Other MEPs advocated for moving ahead with implementing the agreement, even if the US continued to disregard it, arguing that legal tools had been specifically designed to take account of such an eventuality. MEPs also asked about the US level of commitment regarding the ongoing discussions in the OECD on Pillar One. Manal Corwin notably said that the priority is currently to stabilise Pillar Two to create certainty for companies and that the question about returning to the table to finalise Pillar One will come after. All the speakers’ statements and presentations can be found here. The hearing can be watched again here.

MEPs and experts look at avenues for simplifying the ATAD

The European Parliament’s FISC Subcommittee held a public hearing on Thursday 15 May to discuss the future of EU anti-avoidance tax Directive (ATAD), currently under evaluation for a possible review. Experts warned that legal ambiguities, fragmented national implementations of the ATAD and overlapping rules raise compliance burdens and enable loopholes. Speakers advocated for greater EU-wide consistency, especially in interest deduction and CFC rules, and called for minimum standards for taxing wealthy individuals’ capital income. Proposals included abolishing outdated provisions, curbing intra-EU profit shifting and introducing EU-level tools like cooperative compliance frameworks and exit taxes. While simplification was broadly supported, experts cautioned against deregulation disguised as simplification. Instead, they emphasized coordinated reforms to enhance fairness, reduce avoidance and preserve revenues for EU priorities like welfare and defence. The tension between tax harmonisation and national sovereignty was acknowledged, with suggestions for non-binding guidelines and gradual convergence to strike a balance. All statements and presentations can be found here. The hearing can be watched again here. Earlier in the day, MEPs also held a workshop on tax incentives to stimulate private investments in the EU while preventing harmful tax practices.

MEPs discuss findings of ECA report on VAT fraud on imports

On Wednesday 14 May, the FISC Subcommittee and the CONT Committee of the European Parliament hosted François-Roger Cazala, Member of the European Court of Auditors (ECA), to present his ECA’s Special Report 08/2025, highlighting significant shortcomings in the EU’s protection against VAT fraud on imports under simplified customs procedures. The report stresses that Member States lost an estimated 89 billion € in VAT revenues in 2022, partly due to cross-border fraud schemes. The ECA criticised weak national checks, poor inter-state cooperation and delays in fraud prevention actions. In response, the European Commission, through the voice of the Director General of DG TAXUD Gerassimos Thomas, announced ongoing efforts to amend the VAT administrative cooperation regulation, aiming to improve data access for the European Public Prosecutor’s Office (EPPO) and enhance cooperation with Europol and OLAF. These changes are intended to address legal obstacles hindering efficient fraud case handling and include measures such as quicker invalidation of VAT numbers and stronger collaboration among anti-fraud entities, he said.

ETAF participates in the EU Tax Observatory Annual Conference in Brussels

On Tuesday 13 May, the EU Tax Observatory held its Annual Conference in Brussels under the theme “Competition or Cooperation? EU Tax Policies for Tomorrow”, focusing on corporate tax competition, wealth inequality and global tax enforcement. Director General of DG TAXUD Gerassimos Thomas outlined the Commission’s tax simplification agenda and upcoming reforms, including the ongoing DAC and ATAD evaluations, while stressing the critical role of enforcement in reducing tax gaps. A central topic of the Conference was the uncertain future of Pillar Two following the US withdrawal, with the Commission reaffirming its commitment to maintaining the rules while exploring a more adaptable coexistence with the US regime. EU Tax Commissioner Wopke Hoekstra highlighted the importance of environmental taxation for a green transition and reaffirmed the EU’s commitment to international tax cooperation. ETAF Head of Office, Michael Schick, joined a panel on the role of tax enforcement in a competitive world, where he stressed the need for simpler and clearer tax laws, particularly for SMEs, where compliance costs are becoming unsustainable and urged EU legislators to “make it easy to comply”.

EESC public hearing "Simplifying the tax framework: Proposals from the civil society"

The European Economic and Social Committee (EESC) will host on Wednesday 21 May from 9:30 to 13:00 a public hearing titled "Simplifying the tax framework: Proposals from the civil society". The public hearing will focus on key elements for analysing the EU taxation legislation to identify areas where simplification, clarifications or streamlining might be needed. High-level speakers, including representatives from the European Commission, legal experts, academics and civil society, will contribute to keynote speeches and panel discussions on reporting requirements and necessary legal tax changes. The event will be webstreamed in original, English and French and open to all without registration via the link here.

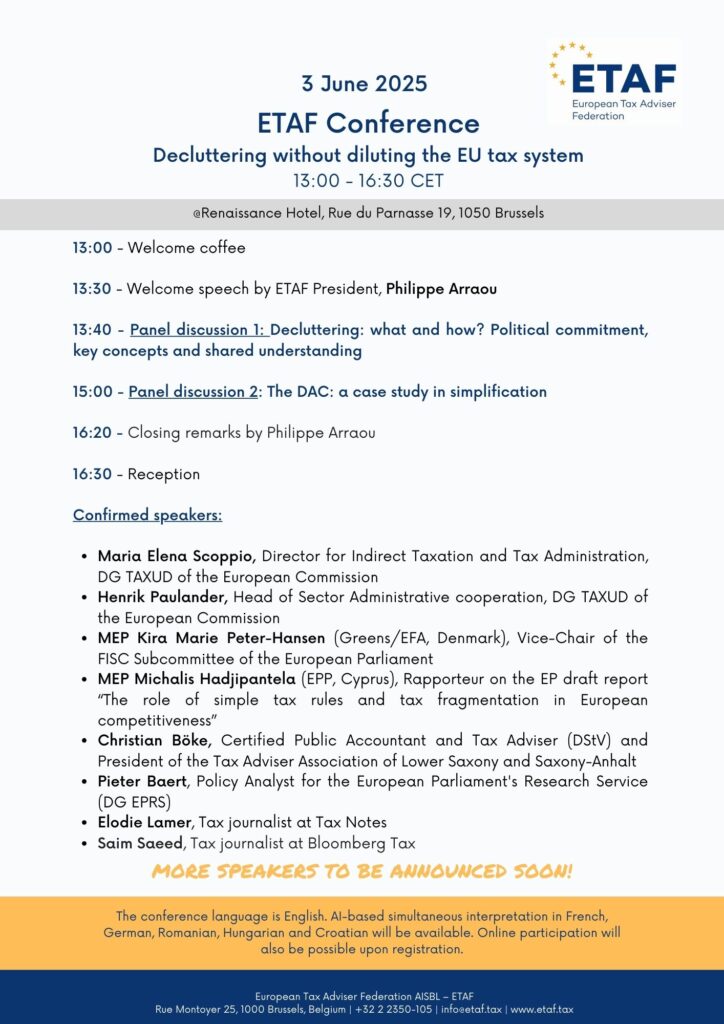

ETAF Conference on 3 June 2025 in Brussels: join us!

Register here:https://sweapevent.com/b?p=etafconferencedeclutteringwithoutdilutingtheeutaxsystem