US Treasury announces extension of its DSTs’ agreement with five countries

The US Treasury announced on Thursday 15 February the extension of the 2021 agreement reached with Austria, France, Italy, Spain and the United Kingdom over their digital services taxes (DSTs) until 30 June 2024. Under the agreement, the five countries will give tax credits to American companies subject to their DSTs against any future income tax liabilities under Pillar One's amount A rules once they take effect. In exchange, the United States, which considers the DSTs as discriminatory against American companies, agreed to withdraw proposed retaliatory tariffs on some US imports of goods from the five countries. The extension of this agreement comes the OECD is working to finalize the text of a multilateral convention (MLC) for implementing Pillar One, with the view to hold a signing ceremony by the end of June.

Four jurisdictions removed from the EU tax blacklist

EU Member States’ permanent representatives reportedly agreed on Wednesday 14 February to remove the Bahamas, Belize, the Seychelles and Turks and Caicos Islands from the EU list of non-cooperative jurisdictions for tax purposes (so-called EU Blacklist). The Bahamas and Turks and Caicos Islands were added to the list of non-cooperative tax jurisdictions in October 2022, while Belize and the Seychelles were added in October 2023. The agreement is expected to be formally approved at the ministerial level on 20 February during a meeting of the General Affairs Council. The revised list is available here.

Work Programme of the Code of Conduct Group under the Belgian Presidency

The EU Council’s Code of Conduct Group on Business Taxation has recently agreed and published its work programme for the duration of the Belgian Presidency of the Council. The Group will complete the review of the tax measures notified by Member States under the standstill and rollback process. The current notification is the first time Member States will notify, if applicable, tax features of general application as defined in the revised Code of Conduct. The Group will also continue to monitor jurisdictions covered by the geographical scope and the implementation of the commitments taken by cooperative jurisdictions. Moreover, the Group will start the screening process of the three new jurisdictions (Brunei Darussalam, Kuwait and New Zealand) included in the geographical scope. The Group will also work on the future criterion 1.4 to incorporate beneficial ownership as a fourth criterion of the EU list on tax transparency, the preparation for the assessment in the second semester of 2024 for criterion 3.2 on country-by-country reporting (CbCR) of relevant jurisdictions that joined the Inclusive Framework after 31 December 2021, the possible screening exercise for trusts and other similar legal arrangements in 2.2 jurisdictions, as well as the interaction between the OECD/G20 BEPS Inclusive Framework GloBE rules under Pillar Two and the criterion 2.2 of the EU list on fair taxation. Three meetings of the group are scheduled under the Belgian Presidency on 7 February, 24 April and 10 June 2024.

MEPs quiz experts on the remaining tax-related obstacles in the Single Market

On Tuesday 13 February, experts presented their views and discussed with MEPs from the FISC subcommittee of the European Parliament how to address remaining tax-related obstacles and distortions in the Single Market, in particular in the context of Enrico Letta’s mandate to prepare a High-Level report on the future of the EU's internal market. Mr Letta announced that the report will not be presented at the end of March as expected, but on 17 April 2024 to allow him to complete his consultations through Europe. He identified three key areas of concern. The first is a weak enforcement of EU directives, which creates fragmentation. The second is the fact that countries use low tax rates and incentives to compete. The third area of concern is that SMEs face 27 different tax systems, he said, adding that the EU may need to invent, in a creative way, something like a 28th regime for SMEs, but maybe also for other companies, both on the corporate law level and on taxation. The other invited experts were Christian Kaeser, Head of tax and Corporate at Siemens, Dominika Langemayr, Professor of Economics at the Catholic University of Eichstätt-Ingolstadt, and Jost Heckemeyer, Professor at Kiel University and Research Associate at the Leibniz Center for European Economic Research, Mannheim. On the same day, the Policy Department for Economic, Scientific and Quality of Life Policies organized a workshop with FISC Members to present and discuss the study on "Good tax practices in the fight against tax avoidance - The signalling role of FDI data".

Enrico Letta to present his first findings on the Single Market’s future on 22 February

MEPs from the European Parliament’s Committee on Internal Market and Consumer Protection (IMCO) will hold a second exchange of views with Enrico Letta, former Italian head of government and President of the Jacques Delors Institute, on Thursday 22 February 2024. The conclusions of the European Council of 29 and 30 June 2023 called for an independent High-Level Report on the future of the Single Market and tasked Enrico Letta with drafting this report. A first exchange of views between IMCO MEPs and Enrico Letta was held on 19 September 2023, allowing for a discussion of their views and priorities on the future of the single market. At this second exchange of views, ahead of the presentation of the final report to the European Council in April, Enrico Letta will present to MEPs, in the presence of representatives from standard bodies, the BEUC and BusinessEurope, his first findings and recommendations in view of the finalization of his report. The session can be followed live here.

MEP Paul Tang’s last FISC meeting

The Dutch Socialist MEP Paul Tang chaired his last FISC Subcommittee meeting in the European Parliament on Tuesday 13 February as he will not run for the European elections in June. The last FISC meeting of the mandate will take place on 19 March but Paul Tang will be unable to chair it as he will be travelling on that day. Paul Tang has chaired the FISC Subcommittee since its creation in September 2020. “I think it’s very good that at least one parliament in Europe is informed about the discussions on European and international taxation”, he said. Mr Tang also hoped that the European Parliament will continue to be active in this area in the future. “I think taxation will be high on the agenda in the years to come, given the demand for fairness in general, but also the stress on the public sector”, he concluded.

Cameroon commits to start automatic exchange of financial account information in 2026

Cameroon has committed to implement the international Standard for Automatic Exchange of Financial Account Information in Tax Matters (AEOI) by September 2026, the OECD announced on Wednesday 14 February. The country is a member of the OECD Global Forum on Transparency and Exchange of Information for Tax Purposes since 2012. The Global Forum will accompany Cameroon’s progress in delivering its commitment to start exchanging automatically by September 2026 and updates will be provided to the Global Forum members and the G20. Hundred twenty-five of the 171 Global Forum members are now committed to start AEOI by a specific date, including 12 between 2024 and 2026, and the vast majority have commenced exchanges, the OECD said.

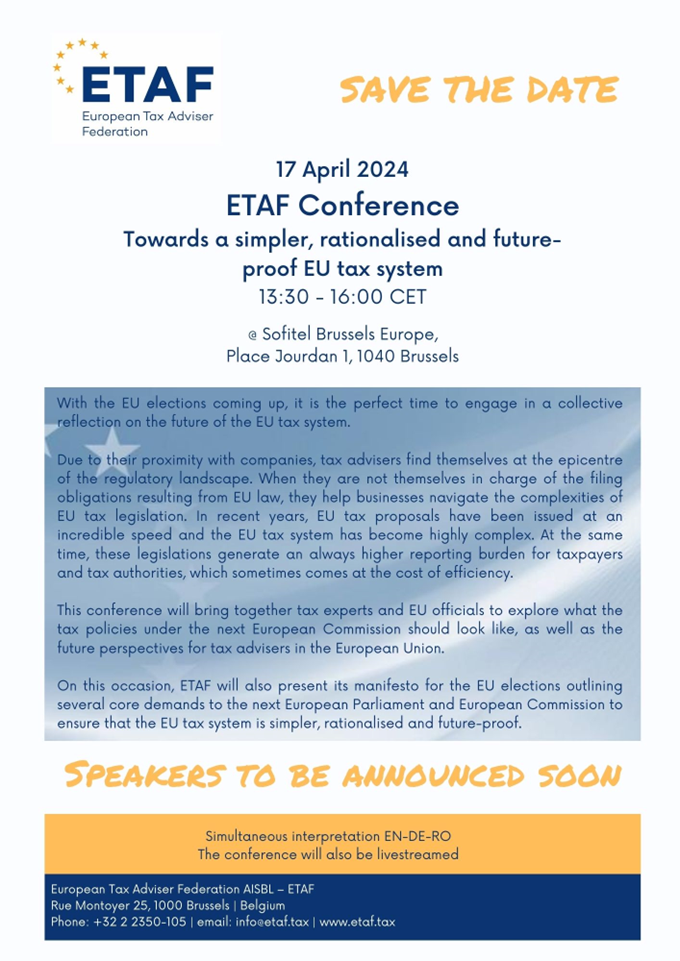

Save the date: ETAF Conference on 17 April 2024