European Commission launches targeted consultation on EU rules for resolving cross-border tax disputes

The European Commission launched on Tuesday 12 March a targeted public consultation to get feedback on the Directive 2017/1852 on Tax Dispute Resolution Mechanisms (DRM), which came into force in 2019 and sets out EU rules on cross-border tax disputes resolution in relation to double taxation issues. As foreseen by the Directive itself, the Commission is now conducting a review and preparing a report on the Directive’s implementation in its first years. Stakeholders are invited to express their views on whether the DRM improved the double taxation relief procedures in the EU compared to pre-existing mechanisms (i.e., MAP, the Arbitration Convention, and national relief procedures). The Commission is particularly seeking views of stakeholders on the application of Article 3 of the DRM (Complaint stage) and Article 4 (Mutual Agreement Procedure stage). The deadline for submission to this consultation is 10 May 2024.

Eurozone Finance Ministers’ statement on the future of the Capital Markets Union

Meeting in an inclusive Eurogroup format on Monday 11 March, the European Finance Ministers finalised and published a statement on the future of the Capital Markets Union (CMU). The statement contains 13 measures, where the Eurogroup invites the European Commission to act during the next legislative cycle 2024-2029. The ministers identified three main areas for action: strengthening the financial architecture to remove barriers to European integration, facilitating companies’ access to capital markets and introducing incentives to increase the participation of retail investors. In terms of tax measures, the European Finance Ministers make it clear that solutions to reduce the debt equity bias are needed but that they should be delivered through their national tax systems. The European Commission is only invited to provide analysis and advice on this topic. This statement sends a strong signal against the Debt-Equity Bias Reduction Allowance (DEBRA) proposal presented by the Commission in 2022. The Eurogroup also invites Member States to assess ways to make their respective personal income tax systems more supportive of investments in capital markets, for example, by reviewing the tax treatment of long-term retail investment products and of capital gains and losses.

European Commission proposes several updates to the EU AML blacklist

The European Commission proposed in a draft delegated regulation published on Thursday 14 March to update the EU blacklist of third-country jurisdictions which have been identified as having strategic deficiencies in Anti-Money Laundering (AML) with the listing of Kenya and Namibia. The Commission indeed considers that these two jurisdictions have strategic deficiencies in their respective AML regimes. The countries listed on the EU AML blacklist will be subject to enhanced customer due diligence measures. The Commission has also taken into account the fact that these countries were identified in the FATF list of ‘Jurisdictions under Increased Monitoring’ in February 2024. Again following similar measures taken by the FATF, the Commission also proposed to remove from the EU AML blacklist Barbados, Gibraltar, Panama, Uganda and the United Arab Emirates (UAE). The Commission considers that these 5 jurisdictions have remedied the strategic deficiencies in their respective AML regimes and no longer pose a significant AML threat to the international financial system. The draft delegated act is now submitted to the European Parliament and the Council for their scrutiny.

No European Parliament’s opinion on energy taxation during the current mandate

The ECON committee of the European Parliament reportedly failed to reach an agreement on its opinion on the revision of the Energy Taxation Directive (ETD), proposed in 2021. Under the revised directive, energy products would be classified according to their energy content and environmental impact, to ensure that the most polluting products are taxed at the highest rate. The main reasons for the failure of MEPs’ negotiations would be proposed measure imposing a maximum zero-rate tax on electricity until 2036, the attempt to exempt nuclear energy, provisions regarding inflation-based indexation as well as the timing of taxation of the shipping and aviation sectors. This failure to agree means that it will now be too late for the EP’s last plenary session in April to adopt an opinion on the ETD before the EU elections in June. Although the EP is only consulted on tax matters, this delay will have some legal implications as the Council of the EU cannot legally adopt a draft tax directive without the opinion of the European Parliament. In the Council, the Belgian Presidency has revived the discussions on the ETD but reportedly said that the positions of Member States are currently hard to reconcile and that more political guidance is needed to advance the file further.

Capital gains tax rates vary widely across Europe, according to a new Tax Foundation’s study

A study published on Tuesday 12 March by Tax Foundation Europe highlighted the great differences in capital gains tax rates across Europe. On average, EU Member States tax capital gains on the sale of listed shares at 18.6%. Denmark tops the list, with a tax rate of 42%. It is followed by Finland and France, with 34% each. At the other end of the scale are Bulgaria and Romania, with rates of 6% and 10% respectively. However, a number of European countries do not levy capital gains tax at all on the sale of long-held shares (Belgium, the Czech Republic, Luxembourg, Malta, Slovakia and Slovenia), the study points out. In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Tax Foundation believes that these capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. Higher taxes also cause investors to sell their assets less frequently, which leads to fewer taxes being assessed, it argues.

European Commission to host a webinar on its HOT proposal on 17 April and 19 June

The European Commission will host a webinar on its proposal for a Head Office Taxation System (HOT), which would allow SMEs operating cross-border through permanent establishments the option to interact with only one tax administration – that of its Head Office. A first webinar will take place on 17 April at 10h and will cover a deep-dive into the proposal, comprising a presentation of the new proposal and a Q&A session where questions of the audience will be answered. A second webinar, with the same content, will be organised on 19 June at 10h. A recording of the session in all EU languages will be made available after the event.

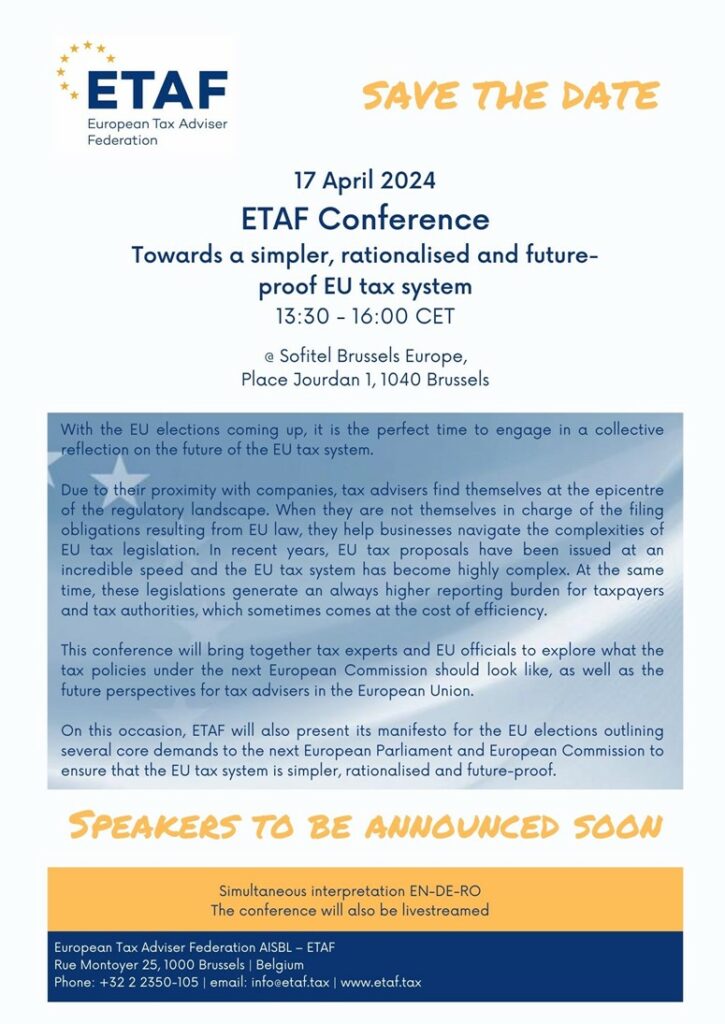

Save the date: ETAF Conference on 17 April 2024