European Commission adopts equivalence criteria for DAC7

The European Commission adopted on Thursday 13 April an implementing regulation establishing criteria to determine whether third-country information exchange regimes can be considered as equivalent to the DAC7 reporting requirements for online platforms. DAC7 indeed contains a mechanism to ensure that platforms reporting to third countries under OECD rules on the income of their EU sellers are not subject to dual reporting requirements. “The assessment and determination of such equivalence should take an approach that ensures that Member States receive the necessary information and prevents excessive burden on the platform operators that have already reported the relevant information in a non-Union jurisdiction”, the Commission explained. To determine the equivalence, the Commission will assess the definitions in the national law of the third-country or pursuant an agreement with a Member States regarding reporting platform operator, reportable sellers and relevant activity. The Commission will also assess the national due diligence procedures, reporting requirements and the rules and administrative procedures of the third country.

2022 progress report on the Fiscalis programme

The European Commission published on 5 April its 2022 progress report on the Fiscalis programme, which aims at supporting tax authorities to enhance fight tax fraud, tax evasion and tax avoidance and improve tax collection. The report shows that, in 2022, the programme was particularly instrumental in guaranteeing business continuity of the European Electronic Systems for taxation and, more broadly, in supporting developments in the field of digitalisation, as well as in fostering cooperation among the tax authorities, the Commission says. In the field of tax gaps, the programme funded a number of activities that helped identifying problem areas for tax gaps and trends. The programme also contributed to the fight against tax fraud, tax evasion and aggressive tax planning through several actions, the Commission said.

New EU Tax Observatory study on the complexity of MNEs and tax avoidance

The EU Tax Observatory published on Wednesday 12 April a new working paper on tax avoidance and the complexity of multinational enterprises (MNEs). The paper investigates the impact of complex ownership structures of MNEs on tax avoidance. Using a cross-country dataset of European affiliates, the authors, Manon François and Vincent Vicard, found that corporations belonging to more complex groups report lower profits than similar affiliates in the same country and industry. Moreover, only the more complex MNEs shift profit away from their high-tax affiliates, while MNEs with a flat ownership structure do not show such tax sensitivity in their reported profits, they say. On the basis of their findings, the authors argue that tax authorities need quality information on the ownership structure of multinational enterprises to better understand profit shifting schemes. A first improvement is the introduction of country-by-country reports that requires all MNEs with a consolidated net turnover of more than EUR 750 million to disclose some financial information in each country in which they have an affiliate, they said. However, there is no information regarding the ownership structure of the MNEs and its complexity and such information would be valuable to tax administrations, according to them.

IASB approves temporary relief from deferred tax accounting under GLOBE rules

The International Accounting Standards Board (IASB) decided on Tuesday 11 April to finalise amendments to IAS 12 Income Taxes following stakeholders' concerns about the potential implications of the OECD Pillar Two model rules for the accounting for income tax in financial statements. The amendments will introduce a temporary exception to the accounting for deferred taxes arising from the jurisdictional implementation of the global tax rules; and targeted disclosure requirements for affected companies to help users of the financial statements better understand a company’s exposure to Pillar Two income taxes arising from that legislation, particularly before its effective date. According to IASB, the amendments will ensure that affected companies apply IAS 12 consistently and that investors are given better information before and after any jurisdictional Pillar Two legislation comes into effect. The final amendments to IAS 12 Income Taxes are expected to be issued by the end of May 2023.

G-24 countries support the UN tax resolution

In a communique issued on Tuesday 11 April during the IMF and World Bank meetings in Washington, the Group of Twenty-Four (G-24), which represents 24 developing and emerging economies, welcomed the UN General Assembly’s resolution on Inclusive and Efficient Tax Reform Initiative and hoped that this would open the door for negotiations on an international tax cooperation agreement through inclusive intergovernmental negotiations at the UN that could address the urgent issues that have so far been excluded from the OECD workstream. In particular, G-24 called for “the creation of a more effective, inclusive, sustainable, and equitable international tax architecture, scaling up international tax cooperation, fighting illicit financial flows and combating aggressive tax avoidance and evasion with greater focus on capacity building to underpin next wave of international tax reform”.

Zimbabwe joins the OECD Global Forum on transparency and exchange of information

On Tuesday 11 April, Zimbabwe joined the OECD Global Forum on transparency and exchange of information for tax purposes and became its 167th member. Members of the Global Forum include all G20 countries, all OECD members, all international financial centres and a large number of developing countries. Like all other members, Zimbabwe will participate on an equal footing and is committed to combatting offshore tax evasion through the implementation of the internationally agreed standards of exchange of information on request (EOIR) and automatic exchange of financial account information (AEOI). Zimbabwe will also join the Africa Initiative, a programme of work launched in 2014 to support domestic revenue mobilisation and the fight against illicit financial flows in Africa through enhanced tax transparency and exchange of information.

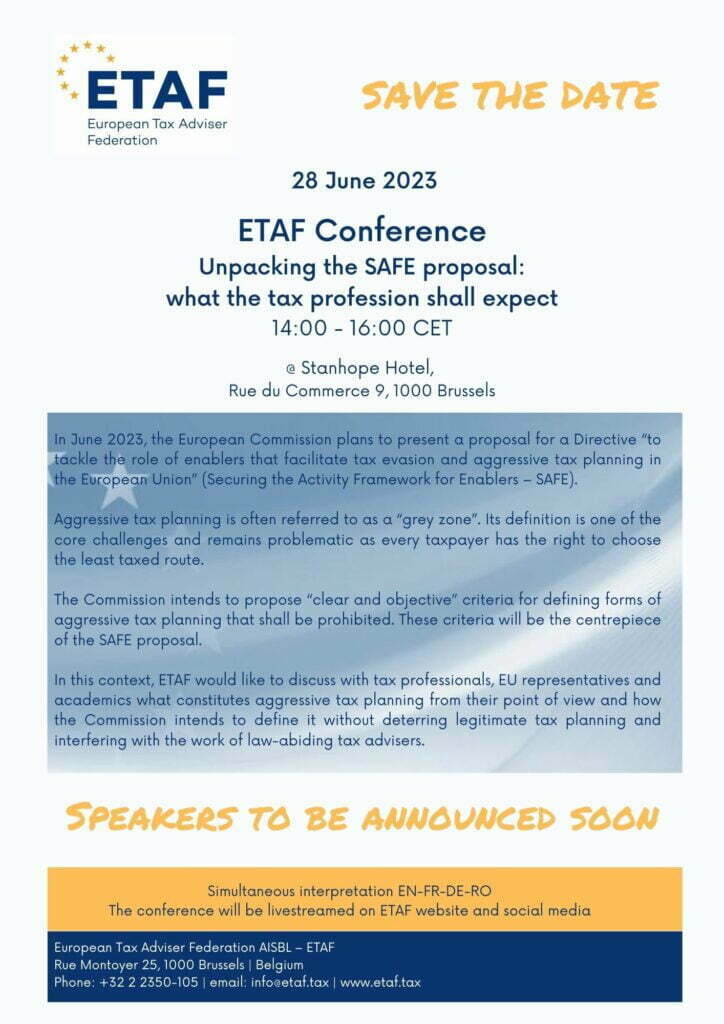

Save-the-date: ETAF Conference on 28 June on SAFE

Disclaimer

This newsletter contains information about European tax policies and developments gathered from official documents, hearings, conferences and the press. It does not reflect the official position of ETAF nor should it be taken as a written statement on behalf of ETAF.