European Commission consults on further possible countermeasures in response to US tariffs

The European Commission announced on Thursday 8 May that is has launched a public consultation on a list of US imports which could become subject to EU countermeasures, if ongoing EU-US negotiations do not result in a mutually beneficial outcome and the removal of the US tariffs. The list put to consultation concerns imports from the US worth 95 billion €, covering a broad range of industrial and agricultural products. The Commission is also consulting on possible restrictions on certain EU exports of steel scrap and chemical products to the US worth 4.4 billion €. This consultation is designed to address both the US universal tariffs and the tariffs on cars and car parts and will remain open until 10 June. While the public consultation is a necessary step in this process, it does not automatically result in the adoption of countermeasures, the European Commission clarified. In parallel, the EU will also launch a WTO dispute against the US on its universal so-called “reciprocal” tariffs and tariffs on cars and car parts, by formally lodging a request for consultations. The two parties will then have up to two months to find a mutually agreed solution. If the consultations fail, the EU will be able to request the establishment of a panel, which will assess the merits of the case.

VAT rules for distance sales of imported goods on the ECOFIN agenda of 13 May

EU Finance Ministers will meet on Tuesday 13 May in Brussels to reach a general approach on the directive on VAT rules for distance sales of imported goods and import valued added tax (VAT). Part of the Customs reform package presented in May 2023, the draft directive seeks to improve the collection of VAT on imported goods by making the suppliers liable for the VAT paid on import. This will give them an extra incentive to use the VAT import one-stop-shop (IOSS) for all VAT obligations. Other topics on the ECOFIN agenda include a policy debate on the proposed Security Action for Europe (SAFE) instrument, a preliminary exchange of views on the new Strategy for a Savings and Investments Union (SIU) and an exchange of views on the state of play of the economic and financial impact of Russia’s aggression against Ukraine.

First insights into the future Single Market Strategy

A draft of the new Single Market Strategy of the European Commission has been leaked in the press, allowing stakeholders to get a first glimpse of what to expect before its official release on 21 May. The 22-page draft document identifies the 10 most burdensome barriers to the development of the Single Market (the so-called “Terrible Ten”). Particularly relevant for the profession is the intention to significantly simplify the recognition of professional qualifications through harmonised assessment standards and the use of digital tools. Tax advisory services are explicitly identified as a highly regulated profession with significant economic impact. The Commission plans to support Member States through guidance and recommendations to avoid unnecessary regulation that could hinder investment and trade. It is also proposed to facilitate cross-border service provision further through the harmonisation of authorisation and certification schemes. The European Commission would like service providers already authorised or certified under EU law in one Member State to be able to offer their services in other Member States without the need for additional authorisation or certification. If needed, a “Single Market Barriers Prevention Act” could be introduced by Q3 2027 to prevent the emergence of new obstacles. The strategy also includes a proposed “28th Regime” to facilitate EU-wide business creation, potentially incorporating tax elements. Additionally, the Commission plans to update its 1994 recommendation on business transfers.

European Commission’s May tax infringement proceedings

On Wednesday 7 May, the European Commission announced several tax infringement actions against EU Member States. Greece has been referred to the Court of Justice of the European Union over its car taxation laws, which impose higher taxes on second-hand vehicles imported from other EU countries compared to similar domestic vehicles. Additionally, an environmental tax applies solely to imported vehicles, which the Commission argues violates Article 110 of the Treaty on the Functioning of the European Union (TFEU) due to unequal treatment. Sweden was also referred to the Court for requiring clients to withhold a 30% preliminary income tax on payments to foreign contractors unless they are approved by the Swedish tax authority. The Commission claims this rule unfairly restricts the freedom to provide services within the EU, especially for contractors without tax liability in Sweden. Lastly, the Commission sent Hungary an additional letter of formal notice regarding its incorrect implementation of the 5th Anti-Money Laundering Directive. Several critical elements of the directive have not been properly transposed into Hungarian law. Hungary now has two months to address the issues before the Commission may proceed to the second stage of the proceeding, by issuing a reasoned opinion.

IESBA releases Q&A on its tax planning and related services standards

The staff of the International Ethics Standards Board for Accountants (IESBA) released on Thursday 8 May a questions and answers (Q&A) publication to support the adoption and implementation of the IESBA tax planning and related services standards. The standards provide a principles-based framework and a global ethical benchmark to guide professional accountants in public practice and in business when they provide tax planning services or perform tax planning activities, respectively. The Q&A publication is designed to highlight, illustrate, or explain aspects of the standards and is intended to complement the basis for conclusions for the final pronouncement. It will assist firms, jurisdictional standards setters, and professional accountancy organizations in adopting and/or implementing the standards, and individual professional accountants in applying them. The Q&A will also assist tax authorities, the corporate governance community, investors, business preparers, educational bodies or institutions, and other stakeholders in understanding the standards. The tax planning and related services standards will come into effect on 1 July 2025.

EU Tax Observatory Annual Conference in Brussels “Competition or Cooperation? EU Tax Policies for Tomorrow”

The EU Tax Observatory Annual Conference in Brussels will take place on Tuesday 13 May on the theme “Competition or Cooperation? EU Tax Policies for Tomorrow”. The event will address key issues such as corporate tax competition, wealth inequality and global tax enforcement. Panels will feature high-level speakers such as Wopke Hoeskstra (EU Tax Commissioner), Gerassimos Thomas (European Commission), Pasquale Tridico (European Parliament) and Gabriel Zucman (EU Tax Observatory). ETAF Head of Office, Michael Schick, will participate in a panel discussion on the role of tax enforcement in a competitive world, along with Reinhard Biebel, Head of Unit Direct Tax Policy and Cooperation at DG TAXUD of the European Commission and World Bank economist Pierre Bachas.

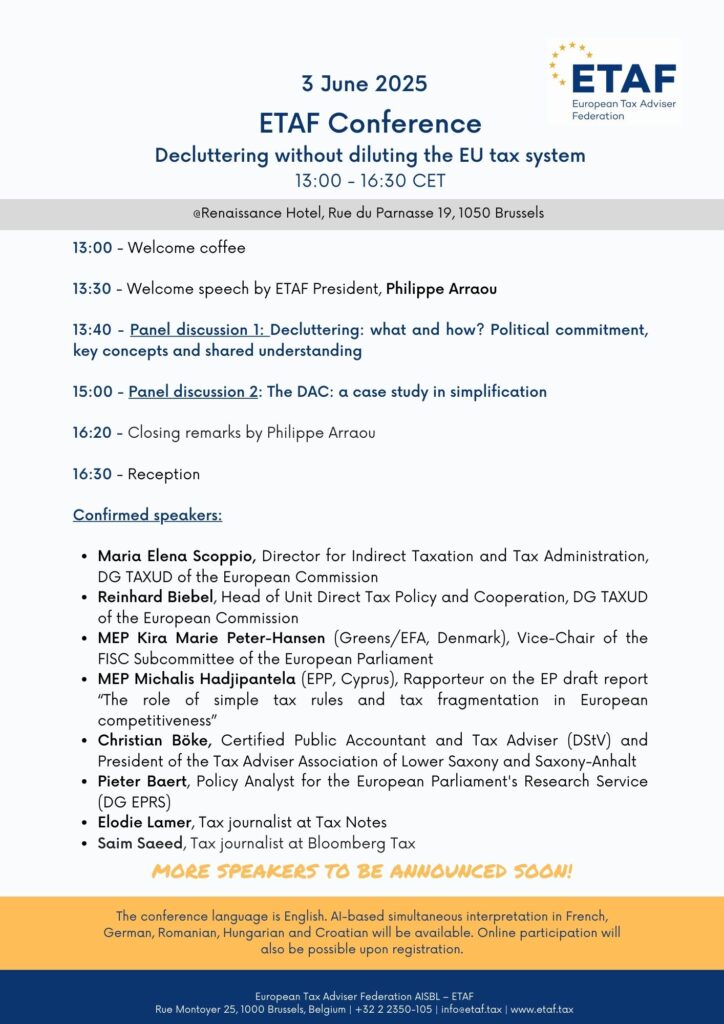

ETAF Conference on 3 June 2025 in Brussels: join us!

Register here:https://sweapevent.com/b?p=etafconferencedeclutteringwithoutdilutingtheeutaxsystem