An adjusted new own resources package to be released on 20 June

The European Commission should present on 20 June an “adjusted” package of new own resources for the EU budget. It should reportedly contain own resources linked to the future carbon border adjustment mechanism (CBAM) and to the review of the European emissions trading system (ETS) as well as a statistical own resource based on corporate profits. The statistical own resource based on corporate profits would reportedly work as the existing plastics contribution does. Member States would have to pay into the EU budget an amount calculated based on the profit statistics of big companies operating in their territories. The proposed statistics-based corporate profits contribution reportedly would apply to both the financial and non-financial sectors. The call rate would be either 0.1 percent or 0.5 percent of big companies’ profits. The contribution would not be an EU tax but rather a national contribution. The Commission initially announced an own resource based on its future proposal Business in Europe: Framework for Income Taxation (BEFIT). The statistical own resource would reportedly be a temporary measure until a BEFIT agreement is reached.

EU Finance Ministers to hold a policy debate on ViDA

During the Ecofin meeting on 16 June, EU Finance Ministers will be invited to hold a first policy debate on the VAT in the digital age legislative package presented in December 2022 and to give political guidance on a number of key issues which are currently the subject of discussions at the level of experts of the Member States. According to a note prepared by the Swedish Presidency of the Council of the EU, numerous questions were asked on the deadlines for the implementation of the new system, more specifically if these allowed for enough time to adapt the applicable IT systems. There is a broad consensus on building an intra-EU digital reporting system based on e-invoicing, as well as on the need to provide for a framework for an optional domestic reporting system, the note says. However, more work needs to be done on the detailed modalities of e-invoicing and digital reporting. In particular, Ministers will be invited to express their views on the three following questions: - With regard to the shift to new technologies such as electronic invoicing and digital reporting, including in the fight against tax fraud, do ministers agree that there is a need to address the fragmentation of the internal market and provide for a consistent framework of reporting based on e-invoicing for intra-EU and domestic transactions?; - Do ministers agree that platforms should have an enhanced role in the collection of VAT in the short-term accommodation and passenger transport sectors to provide for more simplicity, better compliance and a level playing field? - Do ministers agree that the one-stop shop concept and the reverse charge mechanism should be enhanced to overcome the need for multiple VAT registrations for businesses that operate in the internal market?

Progress on tax files under the Swedish presidency

On 16 June, the Council of the EU is expected to approve the biannual Ecofin report to the European Council on tax issues. This report provides an overview of the progress achieved in the Council during the term of the Swedish Presidency, as well as an overview of the state of play of the most important dossiers under negotiation in the area of taxation. It mentions in particular the agreement between Member States on 16 May about the eighth amendment to the Directive on administrative cooperation in tax matters (DAC8). On the UNSHELL Directive, it says that the objective of the Presidency was to make as much progress on this file as possible, focusing inter alia on finding accurate substance criteria and tax consequences. Progress was made on a number of controversial issues, such as the scope, criteria of minimum substance, tax consequences and tax residency certificate, it says. However, further discussions will be needed in order to find compromise solutions on outstanding issues, also with the common objective to limit administrative burdens for both taxpayers and tax administrations. Delegations stressed the interlinkages between different parts of this complex Directive, meaning that an orientation chosen in one part of the Directive might influence the solution in other parts, the Presidency adds.

New EU Tax Observatory working paper on digital service taxes

On Monday 5 June, the EU Tax Observatory published a new working paper taking stock of the first few years of digital service taxes (DSTs) implementation. Currently, twelve countries – both OECD and non-OECD – have an active DST in place. Current tax revenues from these DSTs are mostly in line with expected revenues, comparable in magnitude to estimated Pillar 1 revenues, and rising rapidly, according to the authors. First experiences (e.g., from the UK) suggest that DSTs can be effective at taxing digital companies that have tended to pay low corporate income tax rates in destination countries in a targeted way, they say. However, the available data remains limited and more research needs to be done to progress towards a full cost-benefit analysis of DSTs. According to the authors, the future of DSTs will depend on two factors: the progress on Pillar 1 and the position of the US on both DSTs and Pillar 1. If Pillar 1 is adopted by the end of 2023, the number of countries having a DST will most likely decrease as the parties of the OECD agreement will be obliged to abolish their DSTs upon implementation of Pillar 1.

New European Citizens’ Initiative calling for an EU wealth tax

A group of economists, politicians and millionaires from seven countries across Europe registered on Thursday 8 June a ‘European Citizens’ Initiative’ (ECI) calling on the EU to adopt a permanent annual wealth tax on Europe’s biggest fortunes. The ECI was registered by László Andor (Hungary), Marlene Engelhorn, (Austria), Lars Koch (Denmark), Patrizio Laina (Finland), Aurore Lalucq (France), Paul Magnette (Belgium), Thomas Piketty (France), and Conny Reuter (Germany). The ECI allows European citizens to call on the European Commission to propose new laws. The initiators of the ECI will have one year to collect one million signatures, starting in July. Last March, more than one hundred members of the European Parliament, already called on the EU to introduce a progressive tax on extreme wealth. According to Oxfam estimates, an annual wealth tax of up to 5 percent on Europe’s billionaires could raise nearly €250 billion a year.

Luxembourg's Amazon ruling is not an illegal state aid, ECJ advocate general says

The European Commission has wrongly found that Luxembourg granted unlawful state aid in the form of tax benefits to Amazon, according to the opinion of Advocate General Juliane Kokott delivered on Thursday 8 June. By decision of 4 October 2017, the Commission found that Luxembourg had granted Amazon unauthorised state aid via a tax ruling made in 2003. The reference system relied on by the Commission in order to review whether there was a selective advantage, namely the OECD Transfer Pricing Guidelines rather than Luxembourg law, was incorrect, Ms Kokott concluded. In the view of the Advocate General, the method selected in the Luxembourg tax ruling also when the OECD Transfer Pricing Guidelines were applied to it would not have been manifestly the incorrect method, nor was it manifestly misapplied. In view of the fiscal autonomy of Member States, however, only tax rulings which are manifestly erroneous in favour of the taxpayer could however constitute a selective advantage. For that reason, the Commission was also unable to demonstrate in its decision that the tax ruling had conferred a selective advantage on Amazon, she concluded. Ms Kokott therefore proposes that the Commission’s appeal be dismissed and consequently that the General Court’s judgment, which annulled the Commission decision, be upheld as to the result if not as to the reasoning. The Court’s judgment will be delivered at a later date and the judges who are to deliberate in this case are not obliged to follow the Advocate General’s opinion.

Outcomes of the 2023 OECD Ministerial Council

OECD ministers issued on Thursday 8 June a joint statement at the conclusion of their Council meeting at Ministerial level. Under the Chairmanship of the United Kingdom, OECD ministers met for discussions around the theme "Securing a Resilient Future: Shared Values and Global Partnerships." During the two-day meeting, they welcomed the launch of the Ukraine Country Programme and welcomed the adoption of a new OECD Strategic Framework for the Indo-Pacific. On tax matters, ministers notably adopted a revised Recommendation on the International Standards for Automatic Exchange of Information in Tax Matters, which covers the updated Common Reporting Standard and the new reporting framework for crypto assets. In their joint statement, ministers state that they will continue to work together to reform the international tax system through “a timely and effective implementation” of the OECD/G20 Inclusive Framework’s two-pillar solution to address the tax challenges arising from the digitalisation and globalisation of the economy.

Uzbekistan joins the OECD Inclusive Framework on BEPS

Uzbekistan decided to join the OECD/G20 Inclusive Framework on BEPS, the OECD announced on Friday 9 June. Through its membership, Uzbekistan has also committed to addressing the tax challenges arising from the digitalisation of the economy by joining the two-pillar plan to reform the international taxation rules and ensure that multinational enterprises pay a fair share of tax wherever they operate. Uzbekistan will also participate in the implementation of the BEPS package of 15 measures to tackle tax avoidance, improve the coherence of international tax rules and ensure a more transparent tax environment. The full list of members of the Inclusive Framework on BEPS can be found here.

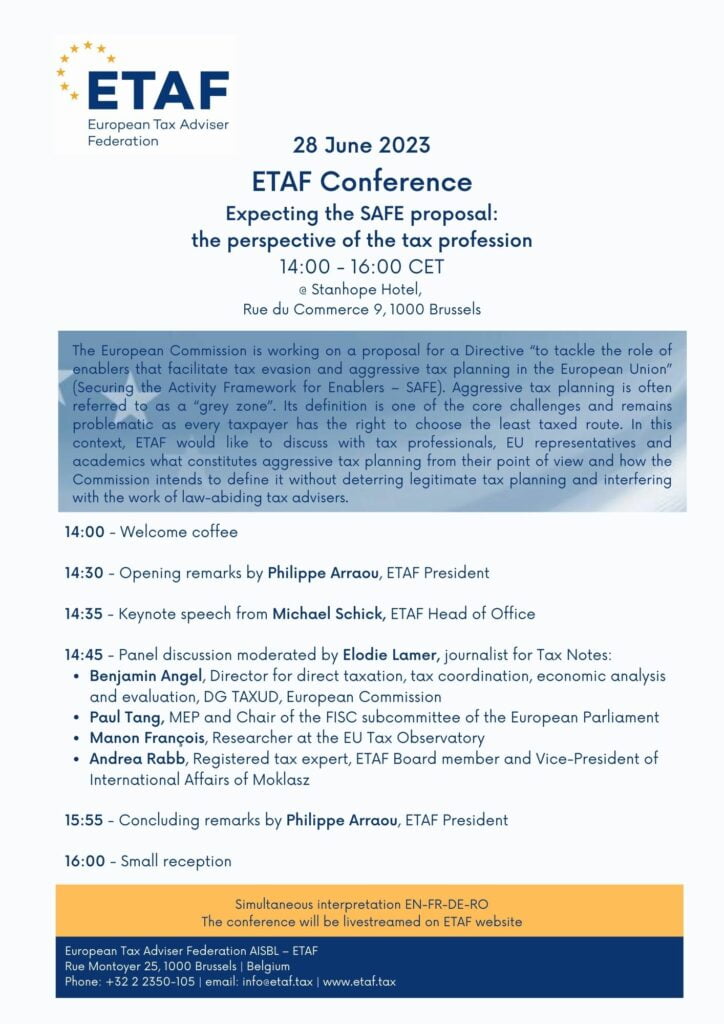

Reminder - ETAF Conference on SAFE on 28 June

Register here: https://sweapevent.com/ETAFConference28June

Disclaimer

This newsletter contains information about European tax policies and developments gathered from official documents, hearings, conferences and the press. It does not reflect the official position of ETAF nor should it be taken as a written statement on behalf of ETAF.