EU leaders agree on an extension of 2021-2027 EU budget

As a follow-up to their meeting in December, EU leaders discussed, on Thursday 1 February during an extraordinary summit, the mid-term revision of the multiannual financial framework (MFF) 2021-2027. In this context, the leaders agreed to greenlight additional funding for a limited number of priority areas through a mix of new and existing funds. The additional funding covers support for Ukraine, migration and the external dimension, the strategic technologies for Europe platform (STEP), Next Generation EU interest payments, special instruments, new own resources and elements that reduce the impact on national budgets. Of the total amount, €33 billion are loans and €10.6 billion are redeployments from existing funding. The extra funding should be distributed as follows: - €50 billion for the Ukraine Facility (€17 billion in grants and €33 billion in loans); - €2 billion for migration and border management; - €7.6 billion for the neighbourhood and the world; - €1.5 billion for the European Defence Fund under the new STEP instrument; - €2 billion for the flexibility instrument; - €1.5 billion for the solidarity and emergency aid reserve. Next, the Council of the EU and the European Parliament need to adopt the mid-term revision. Moreover, in light of the demands of farmers, who protested the same day in Brussels, EU leaders discussed challenges in the agricultural sector and decided to launch a project to simplify the rules of the Common Agricultural Policy (CAP).

European Parliament and the Council organize a public hearing on the future AMLA site

On Tuesday 30 January, the European Parliament and the Council of the EU held a public hearing with regard to selecting the future site of the Anti-Money Laundering Agency (AMLA). The nine candidates (Brussels, Dublin, Frankfurt, Madrid, Paris, Riga, Rome, Vienna, and Vilnius) to host the future AMLA presented their bids and answered questions from MEPs and Council representatives. This was the first time that public hearings are part of the process to select the seat of a new EU agency, following the EU Court judgment that gave Parliament an equal say with Council in determining the host cities of future agencies. Next, the final decision on the location of AMLA’s seat will be made by the co-legislators in a joint vote on 22 February. The location of the seat resulting from the process will be included in the AMLA regulation and formally adopted as part of the legislative text. Parliament and Council have reached provision agreements on other parts of the package of measures against money-laundering and terrorist financing. Before the package can enter into law, the co-legislators need to formally adopt the laws, which they have committed to doing before the EU elections in June 2024.

Belgian Presidency proposes new compromise text on the FASTER proposal

The Belgian Presidency of the Council of the EU has reportedly proposed exempting only small stock markets with comprehensive withholding tax relief-at-source systems from the related provisions of the Faster and Safer Relief of Excess Withholding Taxes (FASTER) proposal. The Belgian presidency seems to pursue the idea to exempt Member States that already have a comprehensive relief-at-source system based on Chapter III of the proposed directive. The Belgian Presidency is reportedly introducing a quantitative eligibility criterion on top of the four qualitative criteria suggested by the previous Spanish Presidency of the Council of the EU. Under the Belgian proposal, which was presented to Member States on 25 January, EU countries with comprehensive relief-at-source systems that have, during two preceding consecutive years, a market capitalization ratio equal to or more than 1 percent shall irrevocably apply Chapter III. The presidency defined market capitalization ratio as “the ratio expressed as a percentage of the market capitalization of a Member State on [31 December] to the overall market capitalization of the European Union" on the same day. The proposal says countries without a comprehensive relief-at-source system would also be required to apply Chapter III, regardless of whether their market capitalization is below, equal to, or above the 1 percent threshold. The Belgian Presidency aims at reaching an agreement on the FASTER proposal at the April Ecofin Council meeting, according to an indicative calendar.

MEPs support better data sharing and less red tape for companies

MEPS from the Economic and Monetary Affairs (ECON) Committee from the European Parliament adopted on Monday 29 January their position on the Commission’s proposal amending several EU financial regulations as regards certain reporting requirements in the fields of financial services and investment support, published in October 2023. MEPs stressed that growing demand for data makes it necessary to gather them in a consistent and standardised way across jurisdictions. They propose to enlarge the scope of the original Commission proposal and decided that not only all European Supervisory Authorities (ESAs) responsible for supervision in the financial sector in the EU, but also the Single Resolution Board (SRB) responsible for resolving banks in distress and the European Anti-Money Laundering Authority (AMLA) would be obliged to follow new rules. MEPs want these authorities to regularly review the reporting and disclosure requirements in order to remove those that are obsolete, disproportionate or duplicative. They should also provide opinions on how to address inconsistencies, redundancy and possible gaps in reporting request included the financial sector legislation both in force and in ongoing legislative procedures. MEPs also want the authorities to strive for the “report once” principle, so that information from financial institutions or other reporting entities is only reported once to one authority. The authorities should share and reuse this information while safeguarding data protection, professional secrecy and intellectual property, they say. The text was adopted with 33 votes in favour, 1 against and no abstentions.

Markus Pieper appointed EU SME Envoy

On Wednesday 31 January, the European Commission appointed Markus Pieper as EU small and medium-sized enterprises (SME) Envoy, to provide guidance and advice on SME issues. Mr Pieper has been a Member of the European Parliament since 2004. He served in the Committee on Industry, Research, and Energy and has been rapporteur on crucial SME-related matters. Prior to his role in the European Parliament, Mr Pieper served as the Managing Director of a regional Chamber of Commerce in Germany. Mr Pieper will take office in the Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs (DG GROW). He will report directly to President Ursula von der Leyen and to the Commissioner for Internal Market on all SME-related activities. The EU SME Envoy will also chair the SME Envoy Network. He will notably work towards bureaucratic burden reduction for companies, filtering upcoming SME-related EU legislation and signalling to the Commission those that merit close attention from an SME perspective. The date of effect of his appointment will be determined later, the Commission said.

European Commission reports technical issues with the CBAM transitional registry system

On Monday 29 January, the European Commission reported technical issues which have led some businesses being unable to submit data and reports related to the EU Carbon Border Adjustment Mechanism (CBAM) and the Import Control System 2 (ICS2). This is due to an incident involving a technical component affecting several EU customs systems, including ICS2, and the functioning of the CBAM Registry, the Commission said. To facilitate reporting declarants who may have experienced difficulties in reporting and have not yet submitted their quarterly CBAM report, a new functionality has been made available as of 1 February on the Transitional Registry, allowing them to “request delayed submission”, giving an additional 30 days to submit their CBAM report. No penalties will be imposed on reporting declarants who have experienced difficulties in submitting their first CBAM report. Delayed submission of a CBAM report due to system errors would, by definition, be deemed justified as long as the submission occurs promptly once the technical errors are overcome, the Commission clarified. Reporting declarants who do not encounter any major technical issue are still encouraged to submit their CBAM report by the end of the reporting period.

An employee using employer’s details to issue fake invoices is liable for amount of tax involved, CJEU says

On Tuesday 30 January, the Court of Justice of the European Union (CJEU) issued a ruling in response to a request for a preliminary ruling under Article 267 TFEU from the Polish Supreme Administrative Court concerning false invoices issued by an employee using his employer's details without his knowledge. In response to the referring Supreme Court's question as to which of the company whose details were illegally used on the invoice and the employee who issued the invoice is liable for the VAT, it was ruled that an employee of a company who issues false invoices and uses the details of his VAT-registered employer is liable for the amount of tax entered on them. This can only happen on condition that the employer, who is subject to VAT, has exercised the diligence reasonably necessary to control his employee's behaviour, the CJEU adds. The CJEU considers that VAT cannot be owed by the apparent issuer of a false invoice when he is acting in good faith and the tax authorities are aware of the existence of a false invoice. A different interpretation would be contrary to the aim of the VAT Directive, which is to prevent fraud and prevent individuals from fraudulently relying on the rules of European Union law, it says. In order to be considered as having acted in good faith, the employer must prove that he has exercised the care reasonably necessary to control the taxable amount, the CJEU concludes.

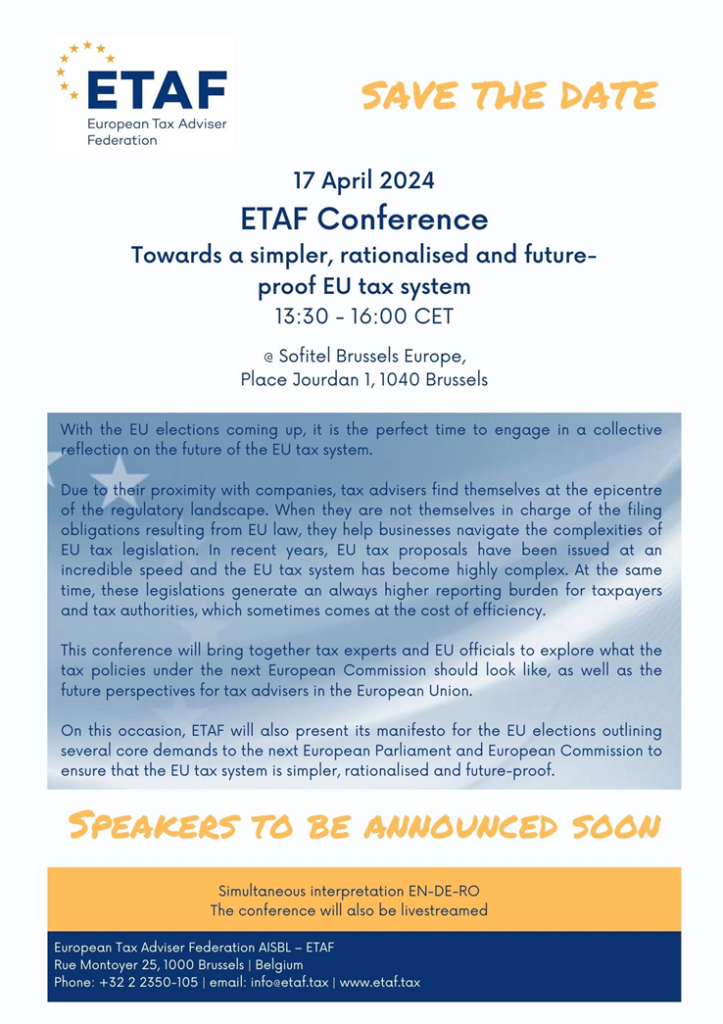

Save-the-date: ETAF Conference on 17 April 2024